By: Mark Glennon*

Illinois Gov. JB Pritzker last month released a proposal to “fully fund” the state’s pensions. Some in the media celebrated the proposal in particularly irresponsible columns.

In truth, the plan is just another can-kick. It’s little more than expanded promises on pensions, pushed to future governors to deal with.

Here are the details:

Under the current repayment plan for our underfunded pensions, the goal is to get the plans 90% funded by FY 2045. That’s the infamous “Edgar Ramp” established in 1995 under Gov. Jim Edgar. Today, the pensions are just 45% funded.

Pritzker’ proposal purports to get the systems 100% funded by changing the ramp and extending it to 2048.

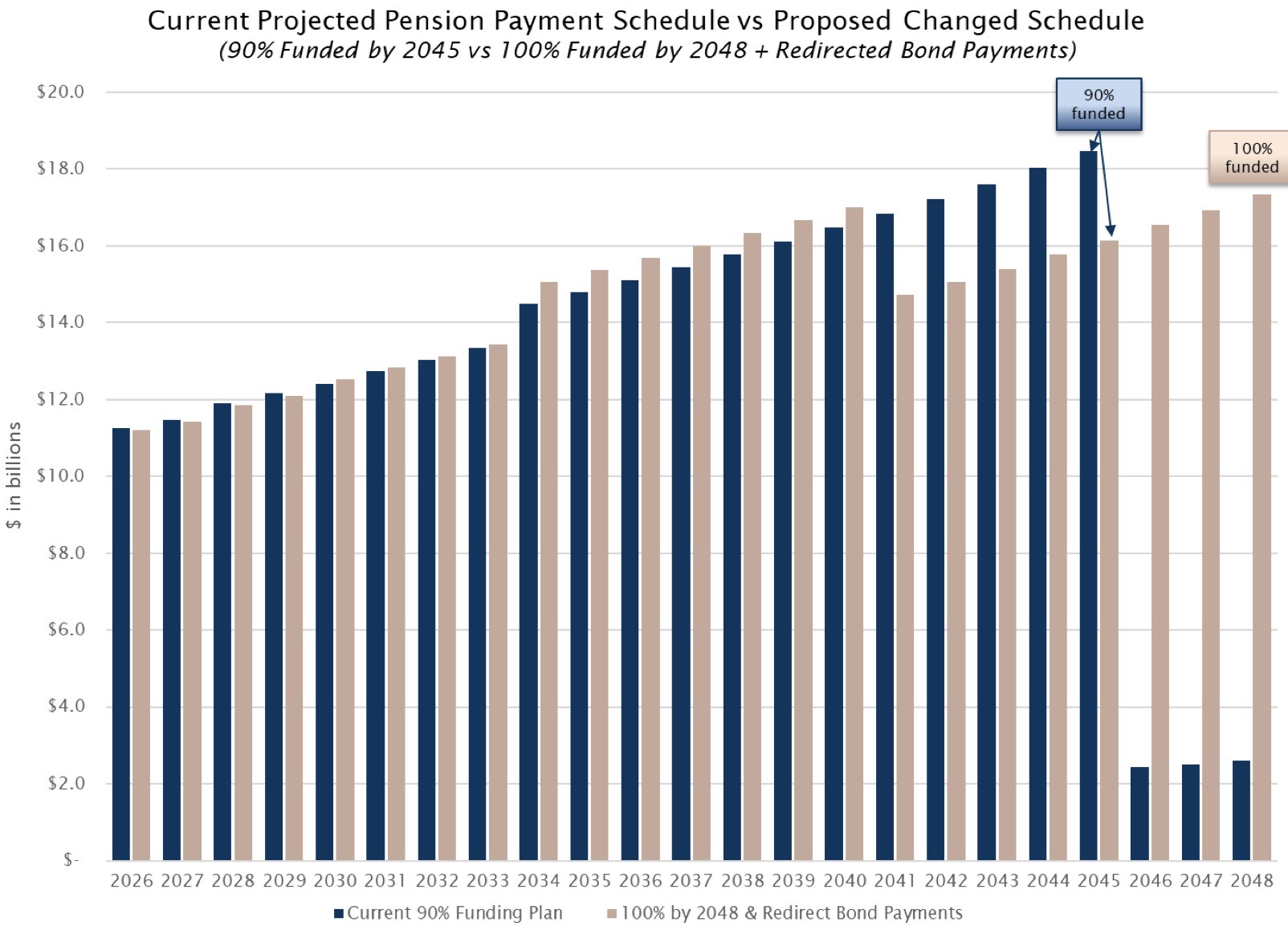

Here is the key chart from Pritzker’s budget documents, where the proposal appears, comparing today’s Edgar Ramp to his new ramp. The dark blue lines are the current Edgar Ramp and the beige lines are Pritzker’s proposed ramp.

Here’s why it’s deceiving:

The new ramp is “overly backloaded, with annual payments increasing at unaffordable rates over time.” Who said that? Some “carnival barker,” as Pritzker calls his fiscal critics? No, that’s from none other than very progressive, tax-and-spend, Pritzker-friendly Ralph Martire of the Center for Tax and Budget Accountability, criticizing Pritzker’s plan in a Chicago Sun-Times op-ed.

Backloading is another term for kicking the can. It’s bad because pension debt effectively bears interest, so lower early payments mean bigger later payments. It’s a means of sticking the next generation with the cost of our generation’s recklessness.

You can plainly see that backloading in the chart above.

Note first that the new ramp apparently would actually decrease state pension contributions a bit each year through 2033. Pritzker no doubt figures he will be on to bigger things than Illinois governor by then.

After 2033, where will the state get the additional money for higher contributions?

That’s where the biggest gimmick is embedded. Specifically, Pritzker’s proposal is for the state to dedicate half the savings the state will get when two particular bond offerings are paid off in 2030 and 2033. Dedicating half of that money then would allow the state’s contributions to drop significantly in 2041, Pritzker claims.

But that’s just an empty promise about where a particular chunk of money would supposedly be used. A dedication to use half the savings from when a few particular bonds are paid off is no more meaningful than promising to use half the money from any other source. It’s no different than saying “We’ll pay lots later.”

That’s because a promise to use those future savings for future pension payments is ephemeral. It would not bind future governors and lawmakers. Even if the promise were made by law, the law could easily be changed with a few lines in any of the thousands of pages of budget bills or other legislation that come out each year. Nothing would stop future lawmakers from doing just that – as they would, assuming they behave like Pritzker, Edgar and so many other past lawmakers. They’d spend the bond savings on something else and kick the pension can again.

Finally, Pritzker’s ramp would push the full funding deadline out by three years, which is another can-kick.

However, Pritzker’s proposal would eliminate the charade of pretending that 90% funding is the appropriate funding level. Targeting less than 100% funding has long been criticized by pension actuaries, being little more than an effort to assume part of the problem away. Looked at it in a vacuum, it’s therefore good and overdue to change the debate to 100% funding. The problem, however, is that Pritzker’s means of getting there is shambolic.

Another gaping problem with Pritzker’s plan is that it ignores the Tier 2 pension mess. Tier 2 pensioners are those hired since 2010 who receive far lower benefits than Tier 1s – so low that they risk being less than Social Security benefits, which breaches federal rules. The state has never published a reliable estimate of the cost of fixing that problem, but it’s widely agreed that the cost will be high and will materially alter any pension contribution schedule.

Some of the press reaction to Pritzker’s proposal continues the tradition of poor reporting and commentary on pensions.

First is an op-ed in the Chicago Tribune by David Greising, president and CEO of the Better Government Association, praising the proposal. The BGS does plenty of good work, but Greising botched this one. Pritzker’s proposal “makes him the first Illinois governor in 30 years to propose a way out of this seemingly insurmountable pension problem,” Greising wrote. But Greising addressed none of what’s written above, apparently being captivated by the 100% funding goal.

Patrick Keck of the State Journal-Register also wrote approvingly of the plan, again seeming bamboozled by the 100% funding thing. “Shifting the goal to fully-fund pensions by 2048 would follow suit with states like Wisconsin and South Dakota that already have met those marks,” he wrote.

But there’s a universe of difference between being fully funded now, as Wisconsin and South Dakota are, and Illinois lawmakers saying they’ll be fully funded in 24 years. It’s as if Keck suggested to somebody deeply behind on their credit card debt to “follow suit” with those who are current on their credit card by promising to do the same by 2048.

Then there’s columnist Rich Miller, who turned to former Republican Rep. Mark Batinick to support Pritzker’s plan and tell us to chill about pensions. He quoted Batinick saying, “Republicans need to realize that while pensions are still a big line item in the budget, the problem is getting better, not worse. Pension costs are declining as a percentage of the budget. We are healing. Democrats need to realize that much of the money that has been available for new spending the last few years has come from that healing, not budget magic.”

But that decline in pension cost as a percentage of the budget (from about 25% to 20%) is only because the budget has exploded, rising 25% (from about $40 billion to $50 billion) from 2019 to 2024. Under that percent-of-budget reasoning, Illinois could get the percentage down to 5%, making Illinois close to competitive on pension burdens with other states, if we’d just raise the budget to $400 billion. Some comfort.

It’s not the first time Batinick has peddled pension deceipt. We ridiculed his 2018 pension proposal as such here and here. Republicans and Democrats alike saw through it and never considered it seriously.

Eleven years ago Democrats and Republicans agreed that our pension problem was so severe that only real pension reform would end the crisis. They said that in legislative findings and argued that in court. It was true then and it’s more true day. Then, the state’s unfunded pension liabilities were $98 billion. Today they are $143 billion.

But our leaders abandoned that effort and reverted to their traditional pension policy, which is deny, delay, extend and pretend. Pritzker’s new proposal is nothing more than that.

*Mark Glennon is founder of Wirepoints.

All Wirepoints research and commentary on Illinois pensions is collected here.