- The dollar strengthened on Tuesday after US inflation data beat forecasts.

- Annual US inflation rose by 3.2%.

- Oil fell on Tuesday after a higher-than-expected US oil production forecast.

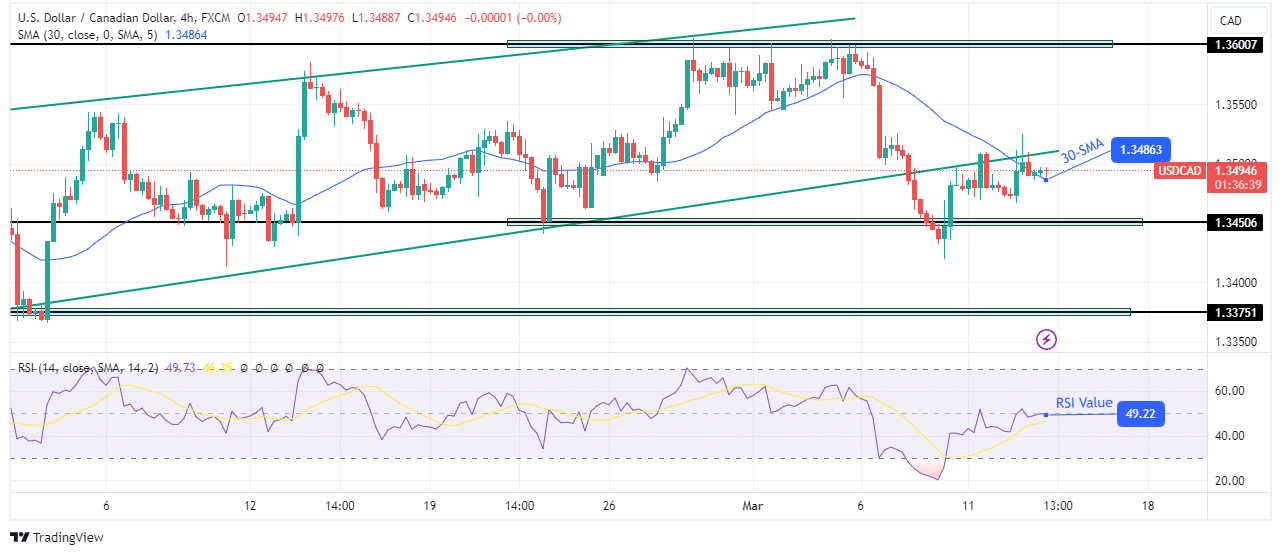

The USD/CAD price analysis reveals a subtle bullish tilt on Wednesday in response to the dollar’s resurgence after an upbeat inflation report. Simultaneously, the Canadian dollar is grappling with weakened strength amid a decline in oil prices.

–Are you interested in learning more about making money with forex? Check our detailed guide-

The dollar strengthened on Tuesday after US inflation data beat forecasts. Annual inflation rose by 3.2%, higher than economists forecast for a 3.1% increase. Meanwhile, the monthly figure rose by 0.4%. Consequently, there was a decline in rate cut expectations. Currently, there is a 67% likelihood of a rate cut at the June meeting. This is a decrease from 71% before the inflation report.

The Fed will only be confident enough to start cutting rates when there is a consistent decline in inflation. However, if inflation remains stubbornly above the 2% target, it could lead to more delays in interest rate cuts.

Investors will now wait to assess the US retail sales report, which shows the state of consumer spending. Retail sales have remained mostly resilient despite higher interest rates. Therefore, there is a chance this trend will continue. If it does, bets for a June cut might fall further.

Meanwhile, the Canadian dollar weakened amid a decline in oil prices. Canada is a significant exporter of oil. Therefore, a decrease in oil prices leads to a weaker currency. Notably, oil fell on Tuesday after a higher-than-expected US oil production forecast. Higher production in the US leads to an increase in supply, which weighs on oil prices.

USD/CAD key events today

USD/CAD technical price analysis: Pause after channel support retest

On the technical side, USD/CAD has paused at the recently broken channel support. Bears and bulls are fighting for control at this level. However, there is a higher chance that bears will win because the indicators support a further decline in the pair.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Notably, the 30-SMA is still facing down as bulls struggle to push the price higher. Meanwhile, the RSI trades slightly below 50 in bearish territory. If bears win the battle and make a lower low below the 1.3450 key support level, it will confirm the channel breakout and a new downtrend. Moreover, the price will likely fall to retest the 1.3375 support level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money