Seniors in the US are sharing their “significant concern” amid calls to raise the official Retirement Age.

Ahead of the 2024 Presidential Election, legislators have floated potential changes to the age threshold for receiving full Social Security entitlement.

Raising the Retirement Age would have “profound implications! for Social Security benefits

GETTY

Marty Burbank, an estate planning expert, addressed the anxieties many older households feel about a potential hike to the Retirement Age in the near future.

He shared: “One significant area of concern for our clients is how changes in Retirement Age might affect eligibility for benefits such as Social Security and Medicare.

“For instance, an adjustment in the retirement age could have profound implications on when an individual can begin receiving benefits and how much they’re entitled to—factors that are critical in structuring comprehensive estate and retirement plans.

“This consideration has been particularly poignant in our Medi-Cal Planning and Veterans’ Benefits services, where we routinely tackle the complexities of aligning federal benefits with personal circumstances and state-specific regulations.”

Currently, Americans can retire early at 62 and claim Social Security benefits but will get payments at a reduced rate.

Anyone aged 65 or over are entitled to Medicare Benefits but they need to have paid the associated taxes for at least a decade.

Some workers choose to postpone their retirement from 67 to 70 to bolster their Social Security benefits.

The Retirement Age was last changed more than four decades ago as part of the Social Security Amendments 1983.

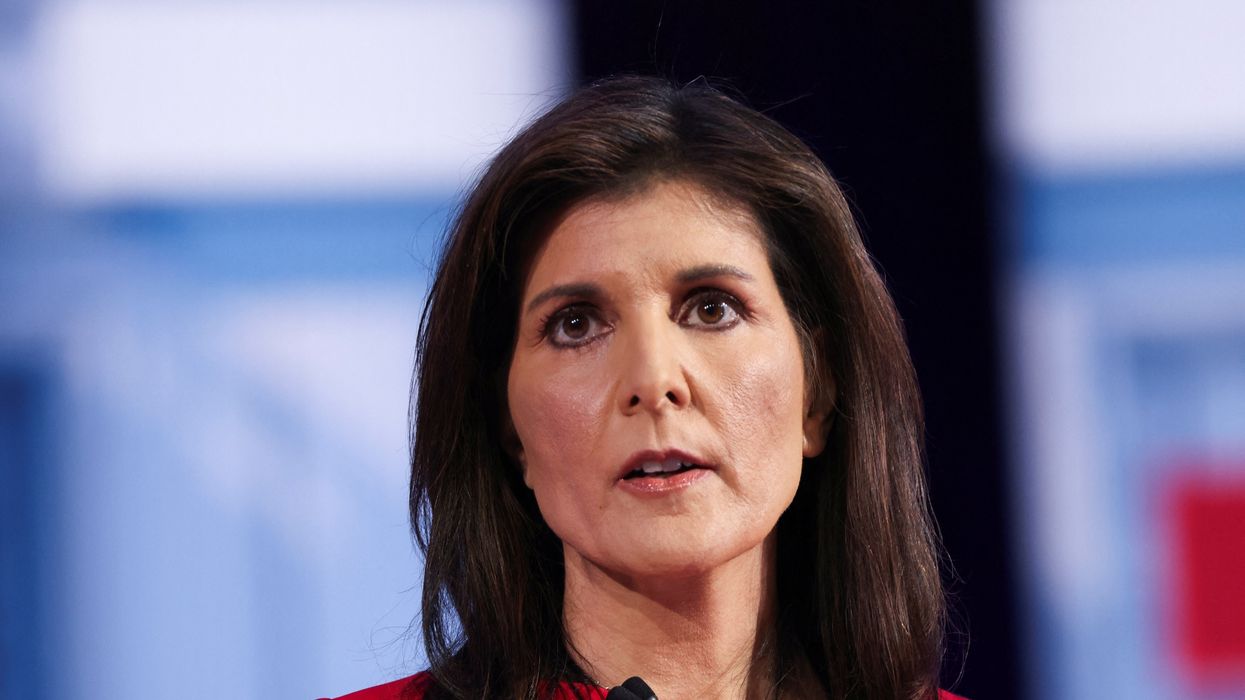

Nikki Haley is among the leading political figures who had floated the idea or raising the Retirement Age

Reuters

With the debate around Social Security likely to continue throughout the year, Mr Burbank called on seniors to have “dynamic estate planning” to fall back on.

The retirement expert added: “Through our work in asset protection and trust administration, we’ve witnessed the importance of adaptable planning strategies that can withstand legislative changes.

“For example, when advising on business succession planning or special needs planning, the potential shift in retirement age necessitates a flexible approach that accounts for varying retirement timelines.

“This adaptability ensures that regardless of when a person retires, their assets are protected, and their quality of life is preserved.”