designer491

One of the beautiful aspects of dividend growth investing (“DGI”) is its versatility.

Two DGIers can have two completely different portfolios of stocks, different emphases and strategies, different weightings of various sectors, and so on.

And then if you throw in tax considerations, you have even more to think about with the difference between taxable accounts and Individual Retirement Accounts, or “IRAs.” You’ve got the traditional IRA that acts like a 401k/403b, deferring taxation on contributions to the future. And then you’ve got Roth IRAs, to which today’s contributions remain part of your taxable income but future dividends and capital gains are untaxed.

On top of all this, there’s age to think about. How close are you to retirement and/or the age at which you can withdraw from retirement accounts without penalty?

I am a younger investor with decades to retirement. I’m also in the somewhat peculiar position that I have more money invested in my taxable account than my Roth IRA due to a few years of higher income in which I had more money to invest than my IRA contribution limit would allow.

In what follows, I want to discuss how my overall dividend investing philosophy is applied across my Roth IRA and taxable accounts. It’s different than how many DGIers would choose to do it, but I think it makes sense for me. And I’m also going to review my retirement account ETFs to make sure they are fulfilling their intended function.

Two Facets of Dividend Growth: Taxable And Roth IRA

In my taxable account, I mainly do stock-picking with a few DGI ETFs that act as a portfolio ballast or anchor (choose your preferred metaphor). My investing goal in the taxable account is to maximize current and future income.

Those may seem like contradictory goals — current and future income — but they aren’t. I am in the working/accumulating phase of my journey and reinvesting all dividends. Thus, the higher the current income, the greater the reinvestment. And the greater the reinvestment, the higher the future income.

This, of course, assumes no permanent losses or dividend cuts, which is why I have become increasingly focused on quality. In stock-picking, my strategy basically goes like this:

- Buy high-quality companies

- that pay a growing dividend

- at a discount to fair value (and thus an attractive dividend yield)

- and wait patiently as they compound over time.

The way I interpret my own strategy’s rules includes both lower-yielding but high-growth common stocks and some high-yielding securities like preferred stocks and closed-end funds (“CEFs”) that offer little to no dividend growth but the ability to reinvest the income stream.

On the other hand, in my Roth IRA, I have opted for a set-it-and-forget-it strategy that aims for maximal long-term dividend growth — in other words, maximal dividend income 2+ decades into the future.

When your investing horizon is literally 2.5 decades, buy-and-hold stock-picking becomes extremely difficult. Who knows what companies will be able to generate strong returns for that length of time?

That’s why I don’t do individual stocks in my Roth IRA. Like most people, I don’t want to actively invest with my retirement account. I don’t want to check it once a day, once a week, or even once a month. I truly want to set it and forget it.

I know that many people find this way of investing backwards. From a tax standpoint, it seems to make more sense to have your low-yielding, high-growth investments in your taxable account and your high-yielding investments in your Roth, where the dividends are untaxed.

But my goal is to someday live off the dividends thrown off from my portfolio without touching the principal. If I wish to do that before the age at which I could begin withdrawing from my retirement account without penalty, then I will need to rely on my taxable account for that. If my taxable account is filled with low-yielding, high-growth investments, then I will presumably need to sell them (in whole or in part) in order to reinvest into higher-yielding investments. Selling them, of course, would involve paying capital gains taxes.

So, if one wants to tap into one’s taxable account for income, there’s no way to do so while avoiding taxes altogether.

I choose to set it and forget it with my Roth IRA, which I view as my “far future safety net,” while being a DGI stock investor in my taxable account for the intervening period.

ETF Components of My Roth IRA

With all of the above said, I must admit that I’m not sure that all of my current Roth IRA ETFs are fulfilling their intended function.

The primary function of my retirement account investments is to generate maximal long-term dividend growth — the highest possible dividend income 2.5 decades from now. Their secondary intended function is to generate maximal price appreciation.

As I peruse the list below, I realize that I could make some changes to better serve my goal of ultra-long-term dividend growth.

| Weighting | ETF | Yield | 5-Year Avg. Dividend Growth |

| 1. | Siren DIVCON Leaders Dividend ETF (LEAD) | 1.1% | 21% |

| 2. | Schwab U.S. Dividend Equity ETF (SCHD) | 3.4% | 13% |

| 3. | Vanguard International High Dividend Yield ETF (VYMI) | 4.5% | 5% |

| 4. | NETLease Corporate Real Estate ETF (NETL) | 5.0% | 4% |

| 5. | First Trust NASDAQ Technology Dividend Index ETF (TDIV) | 1.6% | 3% |

| 6. | Vanguard High Dividend Yield ETF (VYM) | 3.0% | 6% |

| 7. | Vanguard Utilities ETF (VPU) | 3.6% | 5% |

| 8. | Vanguard Real Estate ETF (VNQ) | 4.0% | 0% |

| 9. | Global X S&P 500 Quality Dividend ETF (QDIV) | 3.1% | 8% |

| 10. | Vanguard Dividend Appreciation ETF (VIG) | 1.8% | 10% |

| 11. | iShares Core High Dividend ETF (HDV) | 3.7% | 5% |

My largest Roth IRA holding is LEAD, a small and relatively unknown vehicle that uses a proprietary stock-picking model that targets dividend-paying stocks that are highly likely raise their dividends over the next 12 months. While most dividend growth ETFs screen for historical dividend growth records, this ETF specifically tries to identify the companies that are most likely to increase their dividends in the near future.

It’s a fascinating model that has led to a very strong dividend growth record for LEAD, although growth has certainly been lumpy.

LEAD definitely serves my goal here of maximal ultra-long-term dividend growth.

SCHD is one of the most popular dividend ETFs, and for good reason. It combines an above-average yield of 3.4% with a stellar dividend growth record averaging in the double-digits.

SCHD also does its job of maximizing ultra-long-term dividend growth.

VYMI performs almost identically to an international value fund on a price basis, only it also targets dividend-paying companies. If international value stocks make a comeback for some reason, then VYMI should perform swimmingly. In the meantime, it offers both a moderately high yield and steady, albeit somewhat inconsistent, dividend growth.

I’d give VYMI a pass here, as it basically accomplishes the goal while providing some international diversification.

NETL provides some exposure to my favorite type of asset — net lease REITs. These investment vehicles offer moderately high yields along with steady dividend growth. They are better than bond proxies, because their income streams grow over time.

I’d say NETL is additive to the other holdings and serves its function.

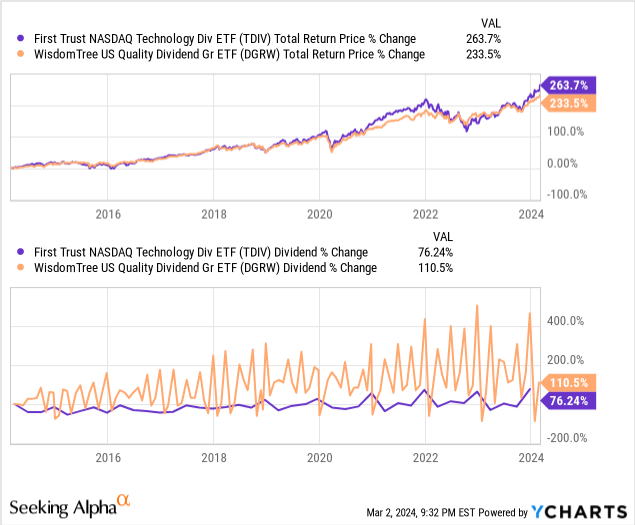

TDIV is a specialized dividend ETF focused solely on tech stocks, including both hardware and software. Despite the technology sector being by far the best performing one in recent years, TDIV’s dividend growth has not been that impressive — about 3% annually over the last 5 years and 7% over the last 10 years.

That isn’t terrible, but it strikes me that it probably makes sense to own a dividend ETF with a large exposure to tech and a quality filter. Otherwise, you simply end up owning every tech stock that happens to pay a dividend, which exposes you to risks like Intel’s (INTC) dividend cut last year.

Although TDIV’s total returns have been impressive, along with the rest of the tech sector, I prefer the balance of total returns and stronger dividend growth provided by the WisdomTree U.S. Quality Dividend Growth ETF (DGRW):

As such, I may decide to sell TDIV and reinvest into DGRW.

On to VYM. This ETF isn’t exactly what I could consider “high yield” with its 3% dividend yield, but it does generate very steady dividend growth of 6-7% per year. It has accomplished this with no down years in its dividend growth since 2010. I’d say that degree of dividend growth consistency gives VYM a place in my retirement account.

VPU is the entire utilities sector, which I originally included because the other ETFs typically have very little exposure to utilities. But neither VPU’s dividend yield nor its historical dividend growth rate are all that impressive.

I would consider selling VPU to reinvest into SCHD and/or DGRW.

Much the same could be said of VNQ, the real estate ETF, which I originally bought because the other dividend ETFs typically have little to no real estate exposure. The problem is that there are some REITs that perform poorly and operate with high leverage. VNQ’s dividend is at basically the same level where it was before the Great Financial Crisis. While a number of individual REITs have very strong dividend growth records, VNQ has a very poor record in this department.

Thus, I am considering selling VNQ to reinvest into SCHD and DGRW.

QDIV may not have quite as good a record as fellow moderate-yielding and quality-focused ETF, SCHD, but its record is still pretty solid. And it is structured differently enough from SCHD to make it worth holding as a diversifier.

VIG also has a very strong and steady dividend growth track record, growing its dividend at a 9-10% rate per year since its inception in 2006. This consistency and reliability is extraordinarily valuable, and VIG more than earns its place in my retirement account.

Finally, while HDV has a fairly above-average dividend yield, I would label both its total return performance and dividend growth record as “fair” or “middling.” Energy is consistently one of HDV’s largest sectors by weighting, and several of its energy holdings pay variable dividends rather than annually growing dividends.

I may consider selling HDV to reinvest into SCHD, DGRW, and VIG.

Why So Little International Exposure?

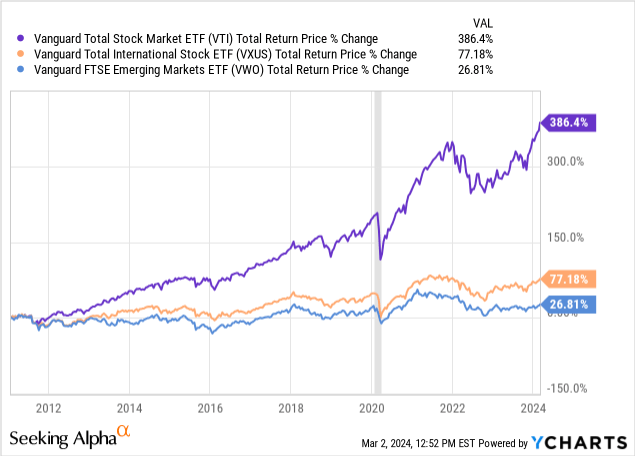

You might wonder why my Roth IRA has so little international stock exposure. We often hear about home country bias among investors. I do hate to exude a superiority complex, but as an American, I think my heavy home country bias is justified.

Looking at the broadest of measurements — broad-based stock indices for the entire US market (VTI), entire international ex-US market (VXUS), and all emerging markets (VWO) — we find an absolutely massive outperformance of US stocks over everything else in the world.

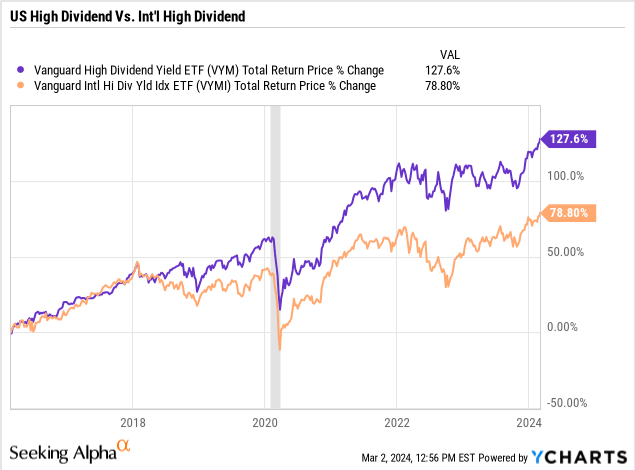

The same holds true of high dividend-yielding stocks:

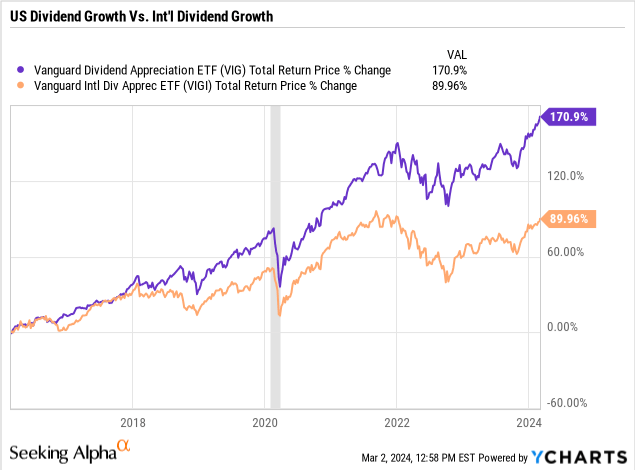

And high dividend growth stocks:

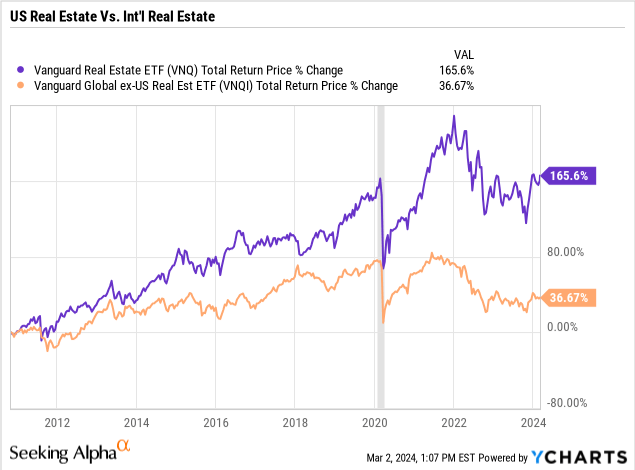

And real estate stocks:

I feel okay about my heavy home country bias for at least three reasons (and probably some more that I’m not thinking of):

- US stocks consistently outperform non-US stocks due to America’s world-leading rule of law, economic growth, technological advancement, population growth, productivity growth, and so on.

- US stocks have plenty of exposure to international markets.

- US stocks tend to follow an annual dividend increase pattern and typically strive to protect and extend their records, while many international stocks do not revere or pursue annual dividend growth as much.

Bottom Line

My goal in my Roth IRA is to maximize long-term dividend growth while utilizing a “set-it-and-forget-it” stance. I rarely ever check my Roth IRA account, and I’d like to keep it that way.

Through this review process, I’ve identified some retirement account holdings that I will consider selling to reinvest into higher growth dividend ETFs.

Hopefully, a similar review can be helpful to you with your own various investment accounts.