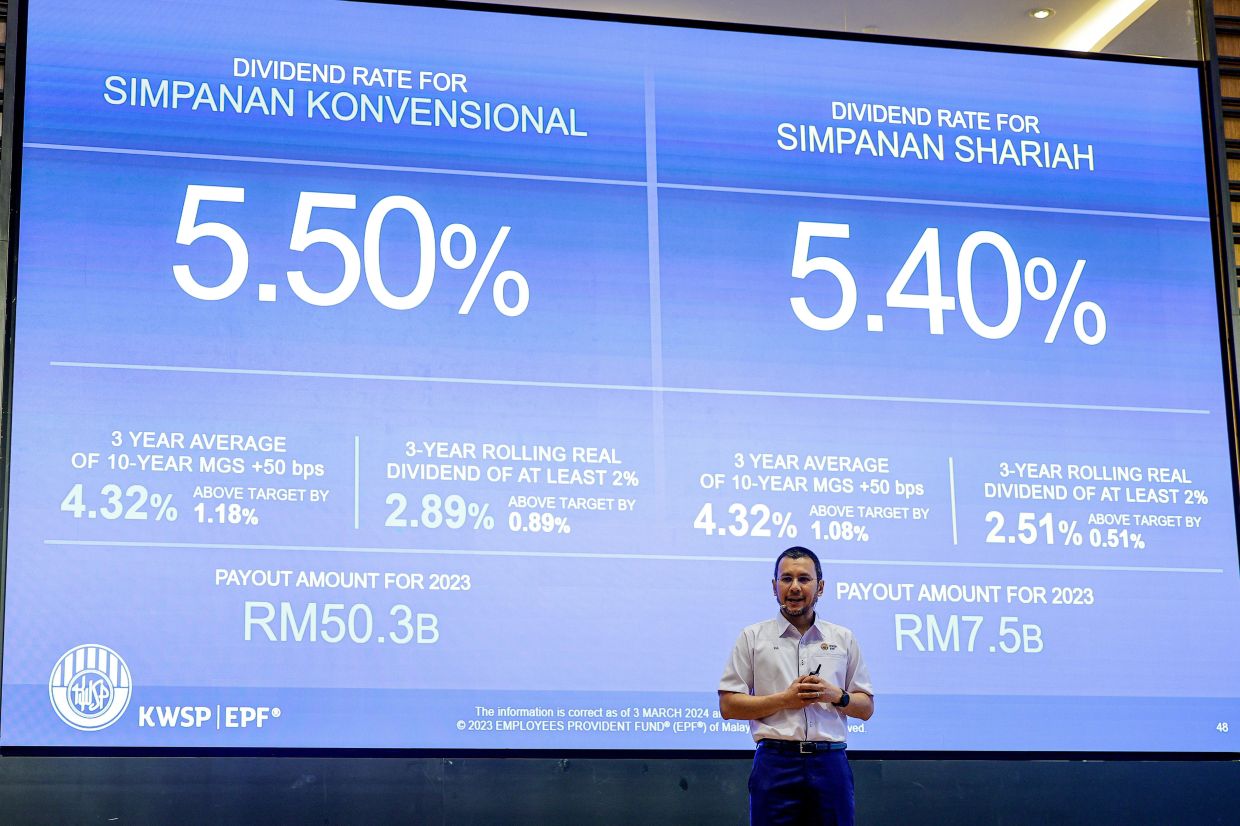

SHAH ALAM: The Employees Provident Fund (EPF) has declared a dividend rate of 5.5% for Conventional Savings for 2023, with the total payout amounting to RM50.3bil.

Meanwhile, the dividend rate for syariah savings was 5.4% with the payout totaling to RM7.5bil.

For 2022, EPF declared a dividend rate of 5.35% for conventional savings with a total payout amounting to RM45.44bil, as well as a 4.75% for syariah savings, with a payout amounting to RM5.7bil.

Over the past 10 years, EPF’s dividend payout for conventional savings has been 6.35% in 2013, 6.75% (2014), 6.4% (2015), 5.7% (2016), 6.9% (2017), 6.15% (2018), 5.45% (2019) and 5.2% (2020).

For syariah savings, it recorded dividends of 6.4% in 2017, 5.9% (2018), 5% (2019), 4.9% (2020) and 5.65(2021).

EPF chief executive officer Ahmad Zulqarnain Onn said the higher syariah dividend rate was mainly driven by investments in technology companies, especially the “magnificent seven” stocks.

“Looking at the financial markets, especially in the US, the rate (of conventional and syariah) converged because a lot of the performance was driven by the ‘magnificent seven’, which refers to the seven tech companies, this include Nvidia that is driven by generative artificial intelligence.

“And a large number of tech companies are shariah-compliant, therefore, we saw that increase in return in the syariah (portfolio),” he told reporters after the EPF Financial Performance Briefing here.

However, Ahmad Zulqarnain added that there would not be a full convergence of both portfolios as one would always be higher than another.

On issues of the proposed EPF contributions for civil servants, Ahmad Zulqarnain said that there might not be any major changes if the group was to become its members.

He added that the matter is still being considered and debated on whether there will be policy changes and if EPF will be the statutory body to manage the fund.

“Given that it’s not a policy yet, we can’t say that civil servants are going to be EPF members.

“If EPF is indeed the statutory body to manage, we don’t foresee major changes of how we do business,” he said, adding that the number of new civil servants joining the public sector is relatively smaller than its current members from the private sector.

“The number of people who joined civil services is about 30,000 people, against our current 16mil members, the number is quite small and very little that we need to do (to adapt to the changes),” Ahmad Zulqarnain said.