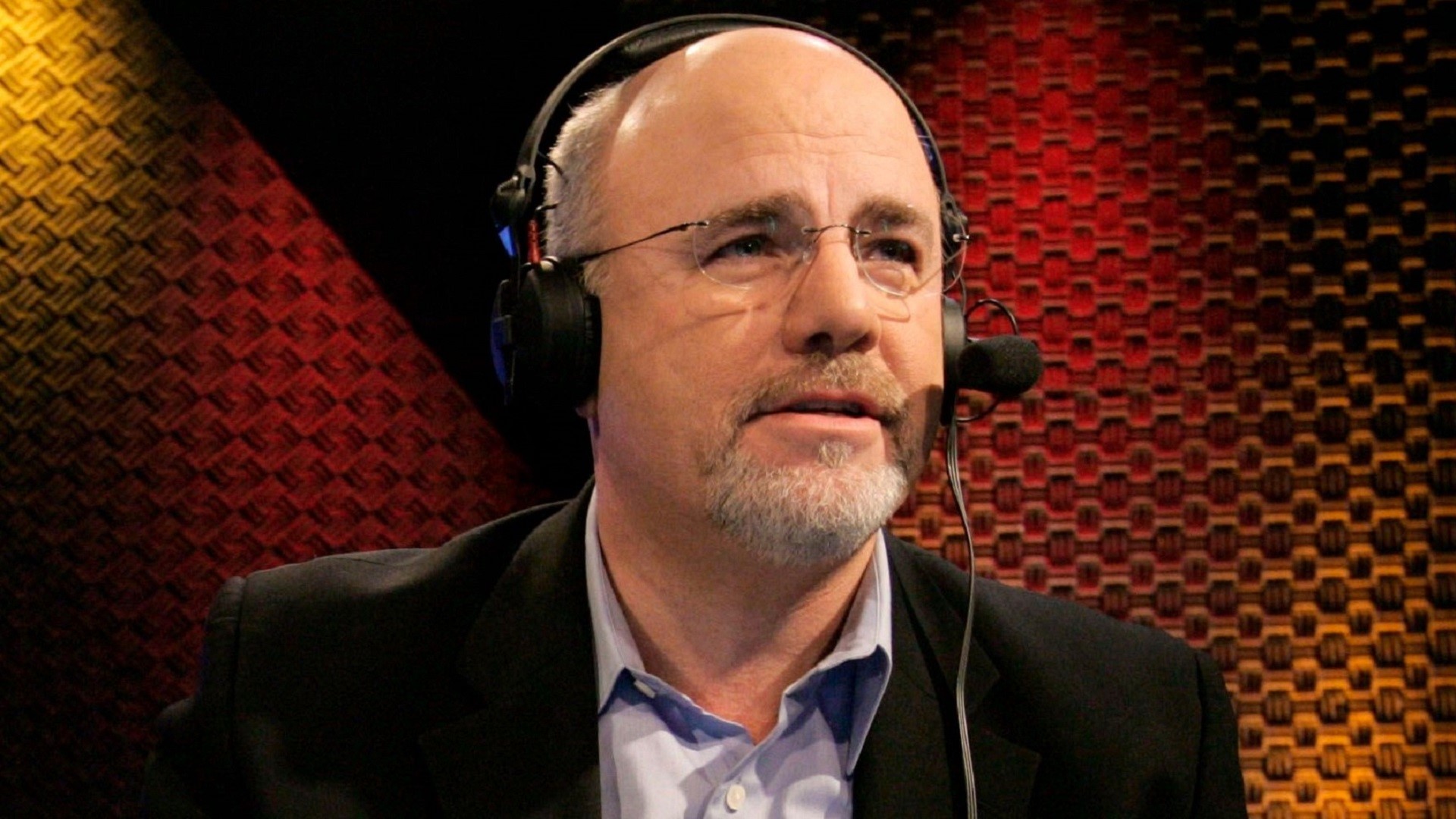

Mark Humphrey / AP / Shutterstock.com

Dave Ramsey, an internet personality and founder of Ramsey Solutions, is passionate about not giving away money. He also frequently emphasizes the importance of saving and investing money, as well as avoiding debt. He lectures people about these topics all the time on “The Ramsey Show” and on his blog.

If you’re someone who’s been “giving away” your money — whether it’s to creditors or otherwise — here are some things Ramsey wants you to do instead.

Prioritize Your Income

“Your No. 1 wealth-building tool is your income,” Ramsey said in video on his channel.

One of the biggest reasons for this claim is that a person’s potential financial success depends on the actions they take with their income.

For Ramsey, it’s not about making more money so you can qualify for a larger loan or higher credit card balance. Nor is it about buying things that won’t give you any future returns. It’s about using it to save and invest as much as you can.

By turning your income into a tool that can improve your financial situation, rather than spending it or accumulating debt, you could end up earning more in the long run. And you can alleviate the stress that often comes with poor financial planning.

Stop Giving Away Your Money

After emphasizing the value of your income, Ramsey then pointed out several areas where people give away their money. In particular, he called out creditors like Sallie Mae and Best Buy.

“When you give your income to someone else, you don’t have it anymore,” he said.

Even if you’re getting something in return — like a house or home entertainment system — you’re still potentially giving thousands or hundreds of thousands of dollars to someone else in the meantime.

Other situations where people end up giving away their money include auto loans, student loans and frivolous or unnecessary expenses. With car payments, Ramsey specifically pointed out that instead of paying a high monthly payment, you could buy a cheaper car outright and invest the money you would have spent on your loan. By doing so, you could have significantly more money by the time you retire.

In his video, Ramsey also criticized people who drive around in million-dollar cars and still have student loans. This doesn’t make much sense to him, perhaps understandably so, given that the money spent on the vehicle could have gone toward the education instead.

Ultimately, it doesn’t matter whether you’re spending your money on car loans, student loans or something else. Ramsey’s whole thing is to stop borrowing money since it can hinder your financial stability in the long run.

Limit Credit Card Reliance

Ramsey noted the absurdity of people relying on rewards tied to credit cards.

“You know how you get a thousand dollars back from Discover?” he asked in his video. “You spent a hundred thousand.”

Although some credit cards do have rewards that are worth getting, relying on them is generally not a financially sound decision. The rewards should be, if anything, an added bonus. They shouldn’t be the reason to accumulate debt.

Ramsey also added that different credit card reward systems are designed to inspire people to go beyond their budgets. But when people spend too much money, the rewards they get are rarely worth the price.

Improve Your Critical Thinking Skills

If you’re trying to build financial security, Ramsey heavily emphasized the importance of improving your critical thinking skills and your knowledge of finances. This is one of the best ways to manage your finances better, avoid debt and build long-term security.

“Adults devise a plan and follow it; children do what feels good,” he said.

It might be OK to spend money based on what’s gratifying to you in the moment when you’re a kid, but you should practice more financial discipline when you’re older.

Don’t Borrow Money Hoping To Build Wealth

It’s not just that Best Buy purchase or that car you need to watch out for; it’s things like new granite countertops for your house, too. In his video, Ramsey heavily criticized the logic behind borrowing money on your home just to make aesthetic upgrades.

Even if these upgrades could increase the value of your home, they might not be the best financial decision. And, according to Ramsey, people can’t borrow their way to wealth — even if they think they can.

Don’t Spend an Arm and a Leg on Education

In his video, Ramsey also commented on people who go to college and end up in major debt for something that doesn’t pay off.

“I’m gonna get a student loan and invest in myself,” he said, citing a common example of people giving away their money on something with minimal returns. “Yeah, you’re gonna spend $140,000 and go in debt and get a degree in freakin’ left-handed puppetry.”

Education isn’t the problem — spending without a plan for your future is.

Gain Your Financial Independence

All of these tips and suggestions are meant to help people build financial security and independence. Ramsey strives to help individuals feel empowered when it comes to their own money.

If you’re trying to gain financial independence, he suggested making a financial plan and a budget, improving your and your family’s knowledge, staying away from debt and investing and saving as much of your income as possible.

More From GOBankingRates