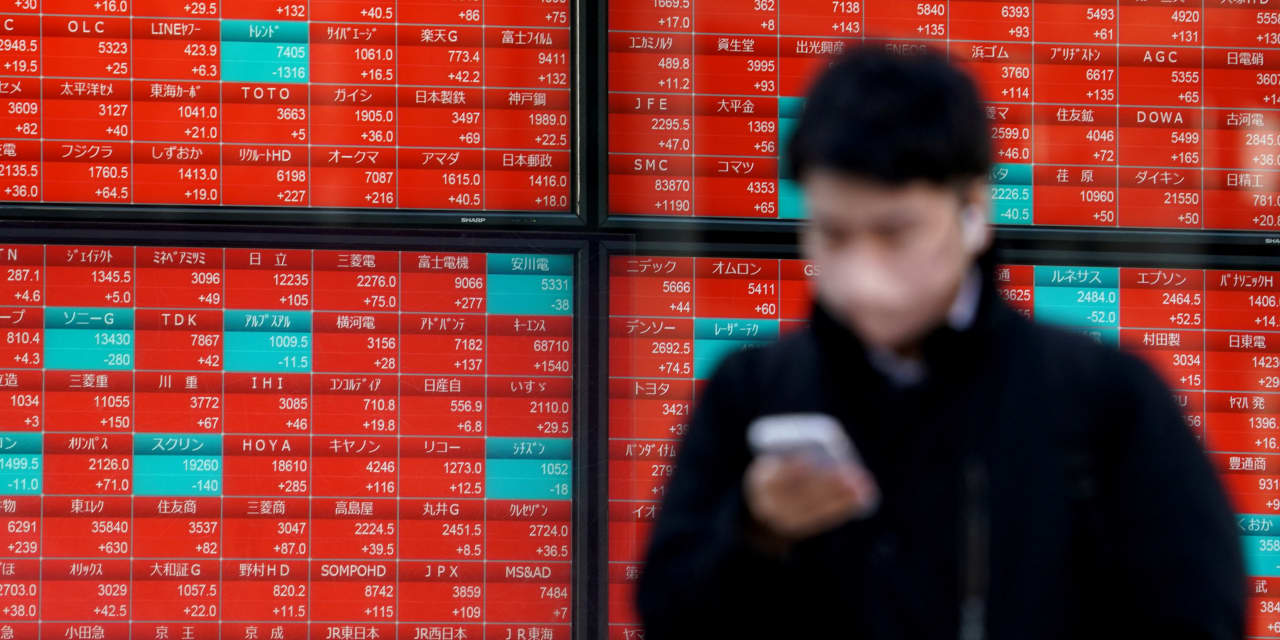

BANGKOK — Shares advanced in Asia on Friday, with Tokyo’s benchmark Nikkei 225 index trading near a record high, 34 years after it peaked and then plunged with the collapse of Japan’s financial bubble.

U.S. futures

YM00

were lower after stocks on Wall Street set another record following some mixed reports on the economy.

The Nikkei 225

JP:NIK

was up 1.5% at 38,718.00. It has been hovering just below the record high of 38,957 that it set in late 1989 right before its asset price bubble imploded.

Share prices have been pressing higher despite persisting signs of weakness in the Japanese economy, which fell into recession in the last quarter of 2023. Efforts to sustain growth at higher levels have had limited success, undermined by weak private investment and consumer spending.

Changes to rules regarding tax-free investment accounts have accounted for some of the runup in share prices. A weak yen has attracted bargain hunters, and Japanese markets also have profited from investors shifting out of Chinese markets.

Elsewhere in Asia, Hong Kong’s Hang Seng index

HK:HSI

jumped 1.8% and the Kospi

KR:180721

in Seoul rose 1.1%. The Shanghai Composite remained closed for the Lunar New Year holiday.

Australia’s S&P/ASX 200

AU:XJO

climbed 0.7%. Bangkok’s SET

TH:SET

rose 0.6% and the Sensex

IN:1

in India was up 0.4%.

Taiwan’s Taiex

TW:Y9999

edged 0.1% lower a day after breaching a record high as major market mover TSMC

2330

,

the world’s biggest computer chip maker, surged nearly 8%. That jump followed an upgrade by analysts of share price recommendations for Nvidia

NVDA

,

whose main chip supplier is TSMC, due to expected growth in artificial intelligence.

On Thursday, the S&P 500

SPX

rose 0.6% to 5,029.73, squeaking past its all-time high set last week. The Dow Jones Industrial Average

DJIA

gained 0.9% to 38,773.12 and the Nasdaq composite

COMP

climbed 0.3%, to 15,906.17.

The mixed set of data on the economy included a report showing sales at U.S. retailers weakened by more in January from December than expected. It was a striking drop in spending by U.S. households, whose strength has helped keep the economy out of a recession, even with high interest rates. The upside for financial markets is that it could also remove some upward pressure on inflation.

A separate report said fewer U.S. workers applied for unemployment benefits last week than expected, the latest signal of a solid job market despite high-profile announcements of layoffs.

Altogether, the economic reports helped send Treasury yields lower in the bond market. The yield on the 10-year Treasury fell to 4.24% from 4.27% late Wednesday.

Treasury yields have been swiveling recently. Stronger-than-expected reports on inflation, the job market and the overall economy have forced traders on Wall Street to delay their forecasts for when the Federal Reserve will begin cutting interest rates.

The Fed has already hiked its main interest rate to the highest level since 2001. The hope is that high rates will squeeze the economy just enough to get inflation down to a comfortable level without causing a recession.

In other trading Friday, U.S. benchmark crude oil

CLH24

edged 1 cent lower to $78.02 per barrel in electronic trading on the New York Mercantile Exchange.

Brent crude

BRNJ24

,

the international standard, shed 13 cents to $82.73 per barrel.

The U.S. dollar

USDJPY

rose to 150.13 Japanese yen from 140.94 yen.