This is CNBC’s live blog covering Asia-Pacific markets.

Asia-Pacific markets are set for a mixed open after Wall Street’s tech-fueled rally dissipated, with Nvidia falling 1.1%, Meta slipping 0.8% and Apple dropping 1.2%.

On Thursday, investors will assess India’s wholesale inflation, while also monitoring any news coming out of Japan’s spring wage negotiations.

Japan’s wage negotiations wrapped up on Wednesday, with the first overall estimate due out on Friday. Reports from local outlets have indicated that large firms offered “major” wage hikes.

Strong wage increases could clear the way for the Bank of Japan to start unwinding its ultra easy monetary policy, with the central bank due to meet Monday and Tuesday.

Japan’s Nikkei 225 is set to fall following these reports as markets price in the possibility of the BOJ tightening policy. The futures contract in Chicago was at 38,460 and its counterpart in Osaka at 38,310 against the index’s last close of 38,695.97.

Futures for Hong Kong’s Hang Seng index stood at 17,155 pointing to a stronger open compared to the HSI’s close of 17,082.11.

In Australia, the S&P/ASX 200 started the day down 0.12%.

Overnight in the U.S., major indexes ended mixed after February U.S. inflation data came in about in line with expectations.

“I think it was a relief to see the [headline] CPI number yesterday, but people are still cautious about the underlying data,” said Ayako Yoshioka, senior portfolio manager at Wealth Enhancement Group. “In the short-term, the macro narrative around the Federal Reserve is going to be the front and center issue.”

The S&P500 closed 0.19% lower, while the Nasdaq Composite lost 0.54%. In contrast, The Dow Jones Industrial Average added 0.1%.

— CNBC’s Brian Evans and Jesse Pound contributed to this report.

CNBC Pro: Chinese stocks are ‘a risk worth taking,’ asset manager says — naming 2 he likes

Asset manager Jason Hsu sees promise in Chinese stocks – naming short and longer-term opportunities to play the market.

“Chinese stocks are trading at the cheapest they’ve ever been. They offer such a big discount and are certainly good investments within a portfolio. There is a risk with China – with how the economy will take form – but with stocks being so cheap, it is a risk worth taking,” Hsu, who is the chairman and chief investment officer at Rayliant Global Advisors told CNBC Pro on Mar. 13.

“I’m always of the view that if you wait around for all the ambiguity or uncertainty to be over – the opportunities will be gone. Everyone is sure that China is going to be back in the race. So, the fact that there is a lot of negative sentiment now means you’re getting a big discount for holding on for future growth in China,” he added, naming two stocks on his radar.

CNBC Pro subscribers can read more here.

— Amala Balakrishner

Oil prices jump more than 2% after Ukraine strikes Russian oil refineries

A man cleans up at an oil depot hit by recent shelling in the course of Russia-Ukraine conflict in Donetsk, Russian-controlled Ukraine, December 7, 2023.

Crude oil futures jumped Wednesday after Ukraine struck refineries in Russia, underlining risks to production and fuel supplies from the war in Eastern Europe.

The West Texas Intermediate contract for April gained $2.16, or 2.78%, to settle at $79.72 a barrel. The Brent contract for May added $2.11, or 2.58%, to settle at $84.03 a barrel.

Ukrainian drones hit a Rosneft refinery in the Ryazan region about 130 miles from Moscow and the Novoshakhtinsk refinery in the Rostov region, according to Reuters. The strikes came one day after Ukraine hit a Lukoil refinery in Nizhny Novgorod, about 265 miles from Moscow.

“We’re seeing oil prices rise, really being led by products on the back of these attacks which have been going on with some regularity since January,” said Andy Lipow, president of Lipow Oil Associates. “The market is pricing in higher and higher probabilities of supply disruptions especially when you damage refineries.”

— Spencer Kimball

AI could help drive EBITDA growth for several gig economy stocks, Barclays says

One of the leading emerging use cases for AI could be automating customer support requests, according to Barclays.

Barclays analysts estimated that for companies in the gig economy, AI could help drive more than 200 basis points of margin improvement from automating requests. The cost per human interaction for completed service requests is $6, while the cost per AI interaction is as low as $1 — and could fall even lower in the future, the firm found.

Analyst Ross Sandler named several companies, including Lyft and Roblox, that stand to benefit from this automation trend. For more, read here.

— Pia Singh

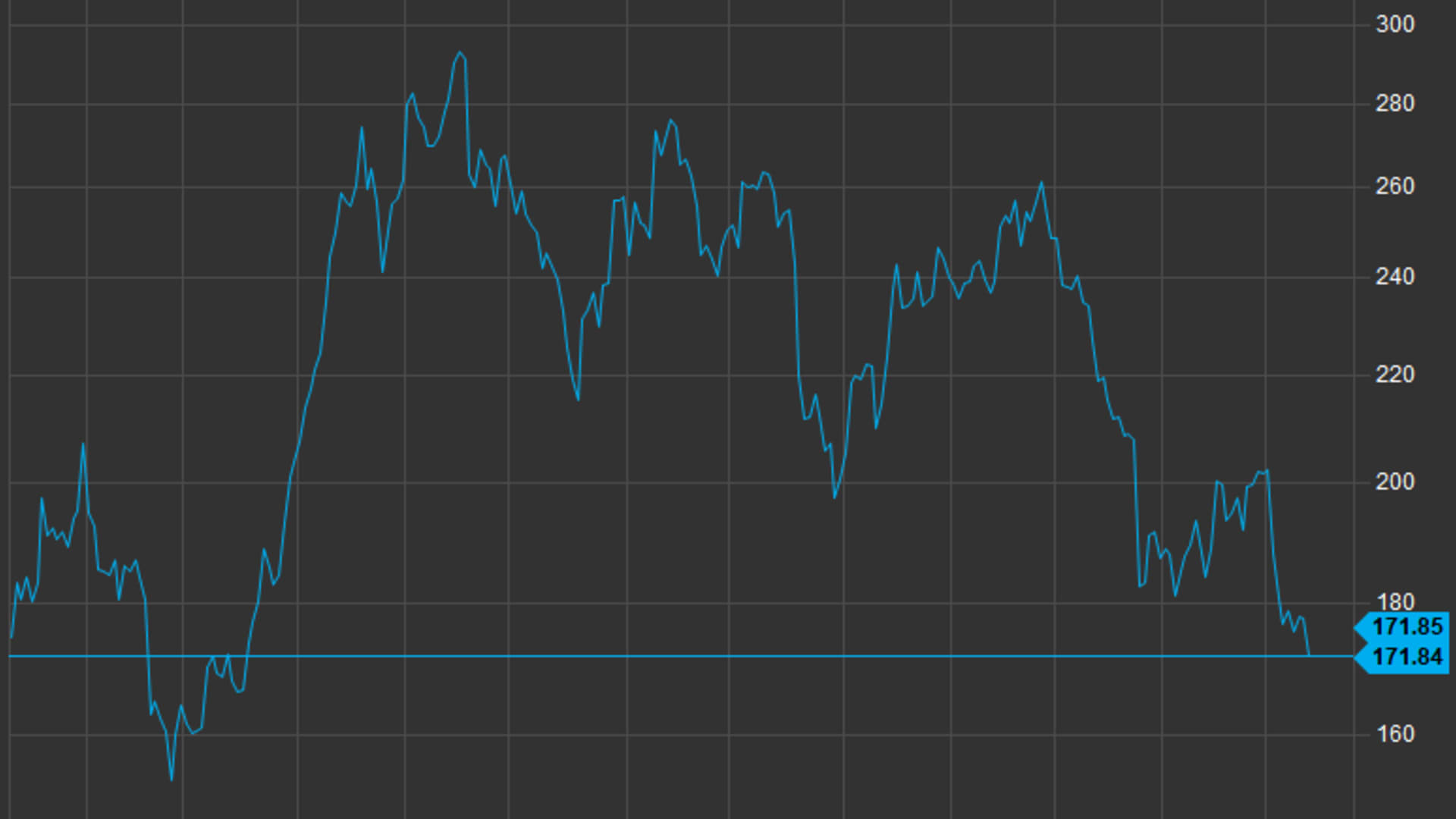

Tesla headed for lowest close since in nearly a year

Tesla shares lost 3% on Wednesday, putting them on track to close at their lowest level since May 2023.

The EV maker was under pressure after Wells Fargo downgraded it to underweight from equal weight. In a note, Wells noted: “TSLA’s growth in core markets has moderated with EU & China flattish in the [last 12 months] & the US down since Q2. More concerning, the effect of price cuts are moderating with 2H volume up only 3% [half over half] despite pricing that’s down 5% h/h.”

— Fred Imbert