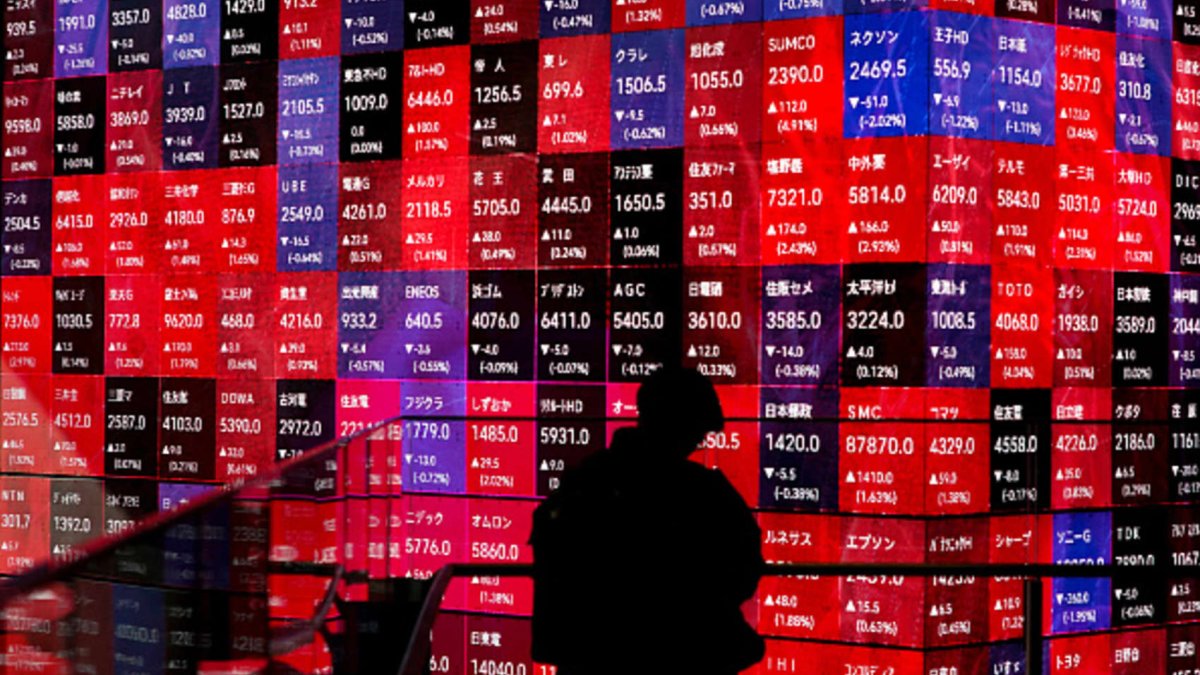

This is CNBC’s live blog covering Asia-Pacific markets.

Asia-Pacific stock markets were set to inch up Wednesday after a subdued session as investors awaited key U.S. inflation and China data during the week, while the interest rate decision from New Zealand was also on tap.

China’s manufacturing purchasing managers’ index reading and U.S. personal consumption expenditures price index — the Federal Reserve’s preferred inflation metric — is due Thursday.

The Reserve Bank of New Zealand is expected to hold its official cash rate at 5.50% later in the day, keeping it at a 15-year high. The earliest rate cut by the central bank is expected to be in July.

Australia’s S&P/ASX 200 and New Zealand’s benchmark S&P/NZX 50 index were little changed ahead of the RBNZ decision.

Japan’s Nikkei 225 appeared set to rise with the futures contract in Chicago at 39,250and its counterpart in Osaka at 39,255 against the index’s last close of 39,239.52.

Futures for Hong Kong’s Hang Seng index stood at 16,855, pointing to a higher open compared to the HSI’s close of 16,790.80.

The S&P 500 and the Nasdaq Composite ended Tuesday with small gains as investors awaited key inflation data to be released later this week.

The S&P 500 inched up 0.17%, while the Nasdaq added 0.37%. The Dow Jones Industrial Average fell 96.82 points, or 0.25%.

— CNBC’s Hakyung Kim and Alex Harring contributed to this report

CNBC Pro: Ark Invest says this ‘optimal’ bitcoin strategy will yield better returns

Bitcoin prices have rebounded since 2023, recovering from steep declines in the couple of years before.

Prices of the cryptocurrency are still rallying. Two weeks ago, it regained its $1 trillion market cap as it hit an over two-year high. On Tuesday, bitcoin prices reached a two-year high of over $56,000.

How much of investors’ portfolios should be allocated to bitcoin, and what’s the minimum amount of time they should hold the asset for? Here’s what Ark Invest says.

CNBC Pro subscribers can read more here.

— Weizhen Tan

S&P 500, Nasdaq Composite close slightly higher Tuesday

A trader works during the closing bell at the New York Stock Exchange (NYSE) on March 17, 2020 at Wall Street in New York City.

The S&P 500 and Nasdaq Composite ended Tuesday’s trading session in the green. Meanwhile, the Dow Jones Industrial Average came under pressure.

The S&P 500 and Nasdaq climbed 0.17% and 0.37%, respectively. The Dow slipped nearly 97 points, or 0.25%.

— Hakyung Kim

CNBC Pro: This Big Tech stock has an ‘absolutely compelling’ valuation, top fund manager says

One Big Tech stock has plummeted over 65% since its all-time high despite growing revenue and earnings.

Andrew Lapping, Ranmore’s chief investment officer, believes the stock is now at an “absolutely compelling” valuation for investors.

CNBC Pro subscribers can read more here.

— Ganesh Rao

Current market rally can’t be compared to the tech bubble, says Citi’s Scott Chronert

While it’s true that the current bull rally is being propelled by AI- and tech-adjacent stocks, Citi’s Scott Chronert disagrees with comparisons to the great Tech Bubble.

“Current multiples are well below ’99-’00 levels. Further, our subjective view is that the fundamental circumstance is meaningfully different now vs then,” Citi Research’s head of U.S. equity strategy wrote.

However, Chronert cautioned that stock fundamentals still have to support the rally in order to sustain his S&P 500 year-end target of 5,100.

“That said, the current spending ramp on gen AI infrastructure and product will need to translate to incremental revenue and growth drivers. But it is premature to judge that,” he added. “While the index may overshoot our year-end 5100 target in the short term, it seems premature to increase the probability of our 5700 bull case scenario.”

— Lisa Kailai Han

Apple cancels plans for electric car and leans into generative artificial intelligence, report says

Apple is canceling plans to build an electric car and is instead leaning into generative artificial intelligence, according to a report from Bloomberg News.

Apple scaled back its vision for the EV project last month and moved initial launch date back to 2028 from 2026, Bloomberg added. The company had originally planned for the car to be fully self driving but instead shifted to a semi-autonomous model last month. Some of the employees devoted to Apple’s EV project will now work on generative AI, the report added.

Apple stock gained 0.5% following the news.

— Brian Evans