Social Security can make or break retirement for many people. Nearly 60% of current retirees say they depend on their benefits as a major source of income, according to a 2023 poll from Gallup, so it’s wise to ensure you’re maximizing them.

One of the most important factors influencing your benefit amount is the age you begin claiming. Age 62 is the earliest you can claim, but for every month you delay (up to age 70), you’ll receive larger payments.

In general, there’s no single right time to take benefits. Your decision will depend largely on your unique situation and retirement goals, so what’s best for one person may not be best for everyone. That said, research shows there’s a clear advantage to filing at one age in particular — and it could boost your retirement income by hundreds of thousands of dollars.

How your age affects your benefit amount

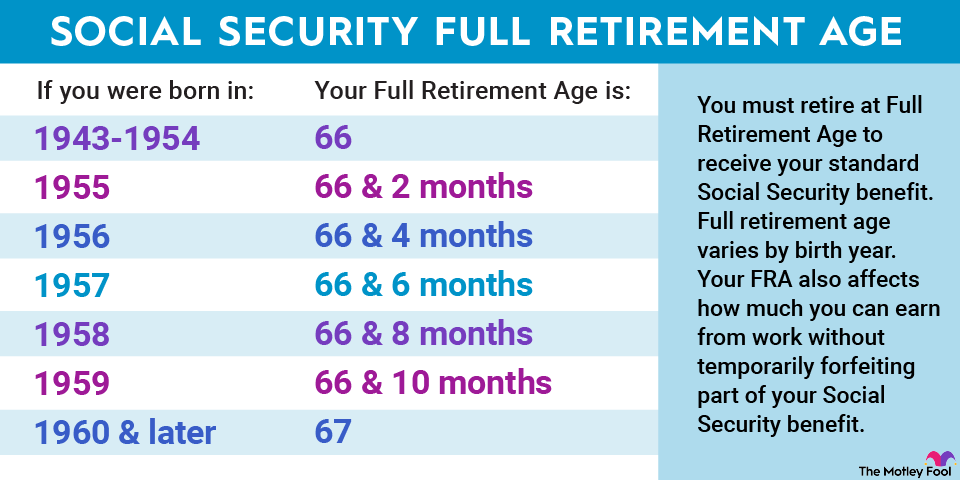

To determine how your age will impact your monthly payments, you’ll first need to know your full retirement age (FRA). This is the age at which you’ll receive the full benefit you’re entitled to based on your work history.

Your FRA will depend on your birth year, but it’s age 67 for anyone born in 1960 or later. If you file before or after that age, it will impact your payments.

File as early as age 62, and your benefits will be reduced by up to 30%. On the other hand, if you wait until age 70 to file, you’ll receive your full benefit amount plus a bonus of between 24% and 32% per month, depending on your FRA.

These adjustments are permanent, too. If you file early or delay, you’ll be locking in those smaller or larger checks every month for the rest of your life. Your decision can impact your payments by hundreds of dollars per month, so this is a critical choice to make carefully.

Most retirees would benefit by filing at a specific age

In 2019, researchers at United Income studied retirees’ claiming decisions as well as how those choices affected their income throughout the rest of their lives. They then used that data to determine how many retirees filed at the optimal time to maximize their lifetime income.

They found that more than 70% of retirees filed for Social Security before age 64, but only 6.5% of retirees would have maximized their lifetime wealth by claiming that early. Meanwhile, around 57% of retirees could have earned more in total by delaying benefits until age 70, yet only 4% of retirees file at that age.

The impact age has on lifetime income is substantial, too. Researchers found that the average retired household will miss out on around $111,000 in income over a lifetime by filing at a less-than-optimal age. Furthermore, around 21% of those who are at risk of not being able to afford retirement could have reduced that risk had they chosen the optimal age to file, according to the report.

What does this mean for you?

According to this data, the majority of retirees can earn more over a lifetime by waiting until age 70 to take Social Security. However, these figures only represent the financial side of the decision, and there’s more than finances to consider.

If your savings are falling short and you know money is going to be tight in retirement, delaying benefits is often the best decision. Waiting until age 70 to file can boost your payments by hundreds of dollars per month, which can go a long way if your savings run out.

For some people, though, claiming early can pay off. While it’s not the most pleasant topic to think about, if you’re battling health issues or have reason to believe you may not live well into your 70s or beyond, it may not make sense to wait until age 70 to take benefits. In fact, in some cases, you could potentially receive more over a lifetime by filing early.

Also, maximizing your monthly payments isn’t a priority for everyone. If you have a healthy nest egg and are willing to make some financial sacrifices in retirement, filing sooner can make it easier to retire early. You don’t necessarily have to begin claiming as soon as you retire, but if you retire in your early 60s and delay benefits, you’ll need to rely on other sources of income in the meantime — which risks draining your savings too quickly.

Claiming Social Security at age 70 is often the best decision when it comes to finances, but it’s important to consider the big picture before you file. There are valid reasons to claim early, too, and by weighing the pros and cons of all your options, it will be easier to decide which age is the best for your unique situation.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets”

The Motley Fool has a disclosure policy.

Social Security: Research Shows This Age Is the Best to Take Benefits — but There’s a Big Caveat was originally published by The Motley Fool