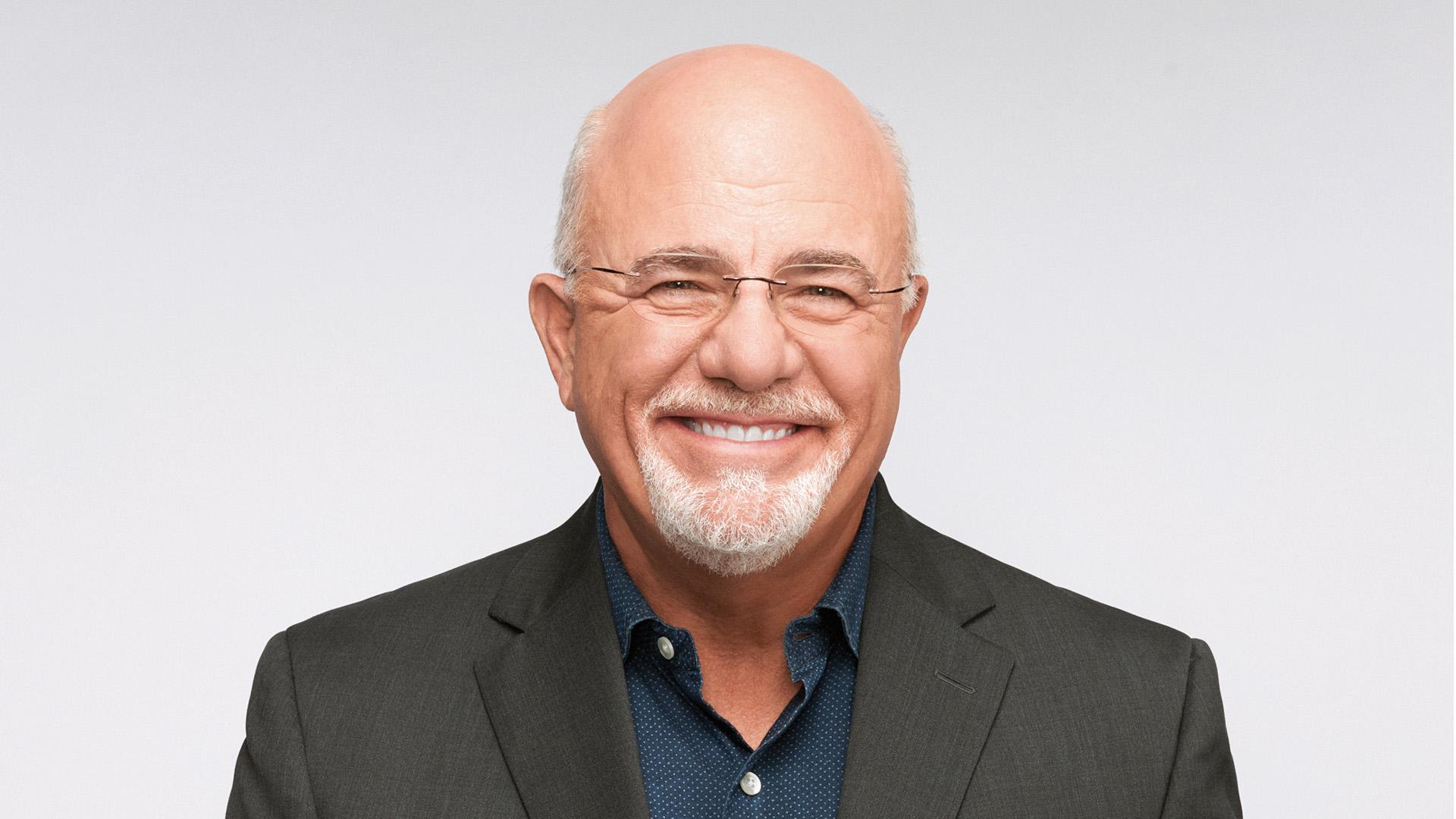

Personal finance expert Dave Ramsey has made it part of his life’s mission to educate consumers on what it takes to live comfortably — and that includes generating enough retirement savings to last through your later years. The Ramsey Show host recently acknowledged there’s a lot of misinformation circulating regarding finance, savings and even Social Security.

In a recent blog post on Ramsey Solutions, he outlined myths that Americans believe about Social Security and other federal benefits, and how you can prepare for a better financial future.

Myth No. 1: Social Security Alone Will Provide a Comfortable Retirement

Many Americans have failed to invest any money for retirement, believing they can live on their Social Security benefits. Ramsey debunked this myth in his article: “Relying on the government to take care of you in retirement is dumb with a capital D,” he wrote.

According to statistics from the Social Security Administration, retirees received an average of just $1,657 per month in 2022 from Social Security benefits. That’s just $19,900 per year, Ramsey pointed out.

According to a recent report, you need at least $49,261 to retire in West Virginia, which is listed as the cheapest state for retirees. In Hawaii, the most expensive state, you’d need $103,610. That means retirees in Hawaii need an additional $2 million or more in savings by the time they reach retirement age — and there is virtually nowhere in the U.S. that you can live comfortably in retirement on the average Social Security check.

Myth No. 2: Medicare Will Cover All Your Healthcare Costs

Once you reach age 65, the federal government pays for a portion of your healthcare costs through Medicare. But, just like Social Security, Medicare is designed to supplement your retirement income; it’s not a universal healthcare system.

Ramsey pointed out that Medicare doesn’t pay for deductibles, co-pays, assisted living or long-term care that exceeds 100 days. The average cost of an assisted living facility is $4,500 per month, GOBankingRates reported. A nursing home, on the other hand, can cost $7,908 for a shared room, up to more than $9,000 for a private room.

Studies show that adults turning 65 now have a 70% chance of needing long-term care as they age, which won’t be covered by Medicare.

Ramsey suggested long-term care insurance as one solution. You can also invest money in a Health Savings Account (HSA), where funds will grow tax-free and you can withdraw money (also tax-free) in retirement to cover healthcare costs.

Myth No. 3: Social Security and Medicare Will Definitely Be Around When You Retire

Finally, Ramsey warned these government safety net programs may not be around in their current forms when you retire. Depending on your current age, Social Security benefits could be cut by more than 20% in 2033, Ramsey wrote, unless Congress finds another way to prevent the shortfall in the Old-Age and Survivors Insurance (OASI) Trust Fund.

Similarly, the federal government may have to change Medicare benefits in the future — including raising the eligibility age, increasing premiums or reducing coverage — to keep the program alive for future retirees.

Bottom Line

Ultimately, Ramsey said, “Your retirement is your job — not the government’s.” If you don’t feel prepared for retirement, no matter your age right now, it can help to speak with a financial advisor who can help you develop a plan to bolster your savings.

More From GOBankingRates