-

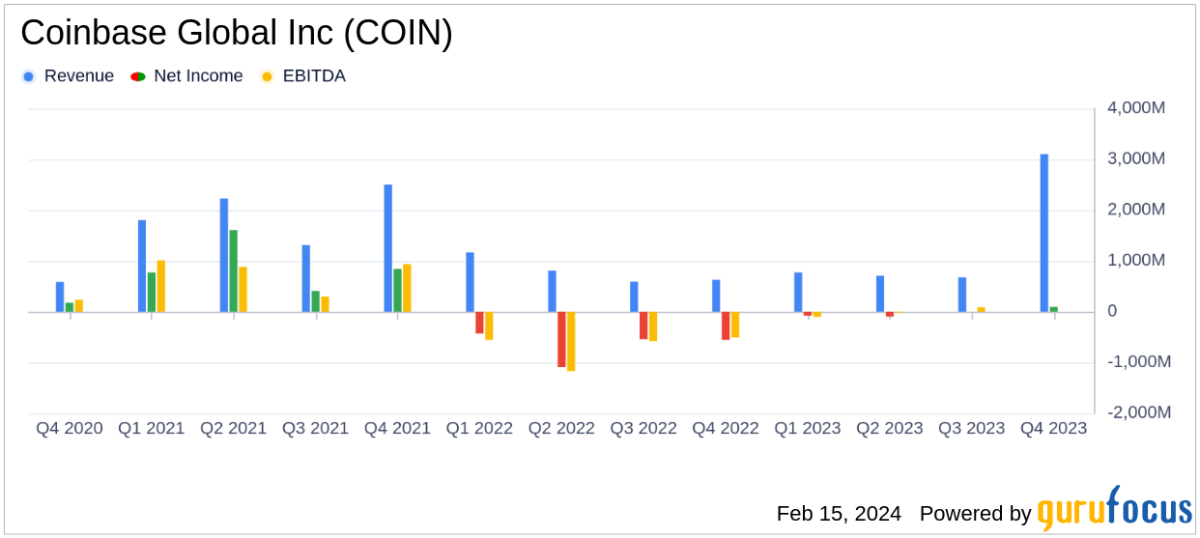

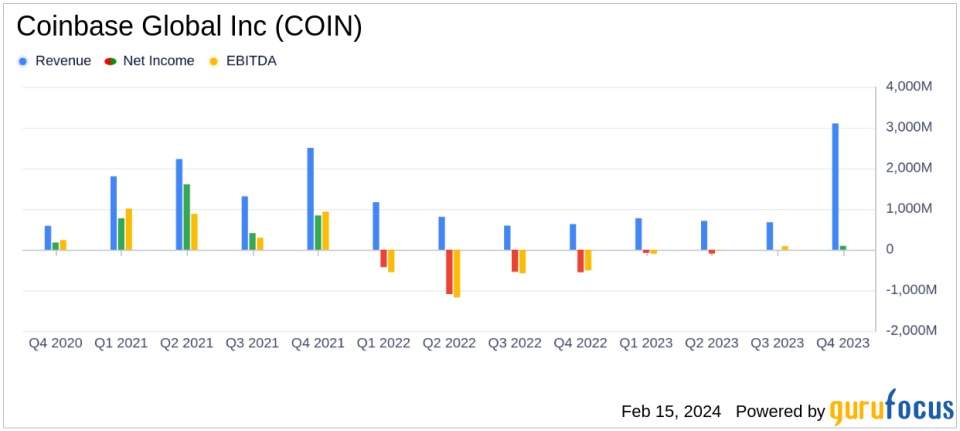

Net Income: Reported a net income of $95 million for the full year 2023.

-

Adjusted EBITDA: Achieved nearly $1 billion in Adjusted EBITDA, consistent with financial goals.

-

Revenue: Total revenue reached $3.1 billion, with a significant increase in subscription and services revenue.

-

Balance Sheet: Strengthened with $5.7 billion in total USD resources and a 12% reduction in total debt.

-

Product Innovation: Launched Coinbase International Exchange and derivative products through Coinbase Financial Markets.

-

Regulatory Progress: Made strides towards regulatory clarity, with 83% of G20 members advancing in crypto regulation.

On February 15, 2024, Coinbase Global Inc (NASDAQ:COIN) released its 8-K filing, revealing a year of strategic growth and financial resilience despite a challenging market environment. The leading cryptocurrency exchange platform in the United States, known for its commitment to regulatory compliance and innovation, has reported a net income of $95 million for the full year of 2023, with an Adjusted EBITDA totaling nearly $1 billion.

Financial Performance and Challenges

Coinbase’s total revenue for 2023 was $3.1 billion, a slight decrease of 3% year-over-year (Y/Y). However, the company saw a remarkable 78% Y/Y growth in subscription and services revenue, which reached $1.4 billion. This diversification of revenue streams is crucial for Coinbase, as it reduces reliance on transaction fees and provides more stable income sources. Despite the overall decrease in total revenue, the company’s operational discipline allowed for a significant improvement in net income, contrasting sharply with the previous year’s net loss of $2.6 billion.

The company faced challenges, including market volatility and regulatory uncertainty. However, Coinbase’s strategic focus on product innovation and international expansion has positioned it well for future growth. The launch of new products, such as the Coinbase International Exchange and derivatives through Coinbase Financial Markets, has expanded its offerings and competitive edge.

Key Financial Metrics

Key financial metrics from the income statement and balance sheet underscore Coinbase’s financial health and strategic execution:

“For the full-year, we generated net income of $95 million and positive Adjusted EBITDA in all four quarters, totaling nearly $1 billion – consistent with our financial goal to generate positive Adjusted EBITDA in all market conditions.”

This achievement is particularly significant for a company in the volatile capital markets industry, where maintaining profitability can be challenging.

Regulatory and Product Development Milestones

Coinbase has also made significant strides in regulatory advocacy and product development. The company’s efforts to drive regulatory clarity have seen progress, with 83% of G20 members moving towards clearer crypto regulations. In the U.S., Coinbase has actively engaged in advocacy, supporting pro-crypto candidates and policies.

The company’s product suite has been enhanced with the launch of Base, a layer 2 network aimed at improving speed and lowering costs for developers, and the acquisition of key licenses and registrations in six new markets. These developments are critical for Coinbase’s growth and the broader adoption of cryptocurrency.

Looking Ahead

As Coinbase looks to 2024, it remains focused on driving revenue through core trading and USDC, enhancing crypto utility, and continuing to advocate for regulatory clarity. With a fundamentally stronger position than a year ago, Coinbase is poised to capitalize on the opportunities ahead.

For a more detailed analysis of Coinbase Global Inc’s financial performance and strategic initiatives, investors and interested parties can access the full 8-K filing.

Value investors seeking in-depth analysis and insights into Coinbase’s financial health and future prospects are encouraged to visit GuruFocus.com for comprehensive coverage and expert commentary.

Explore the complete 8-K earnings release (here) from Coinbase Global Inc for further details.

This article first appeared on GuruFocus.