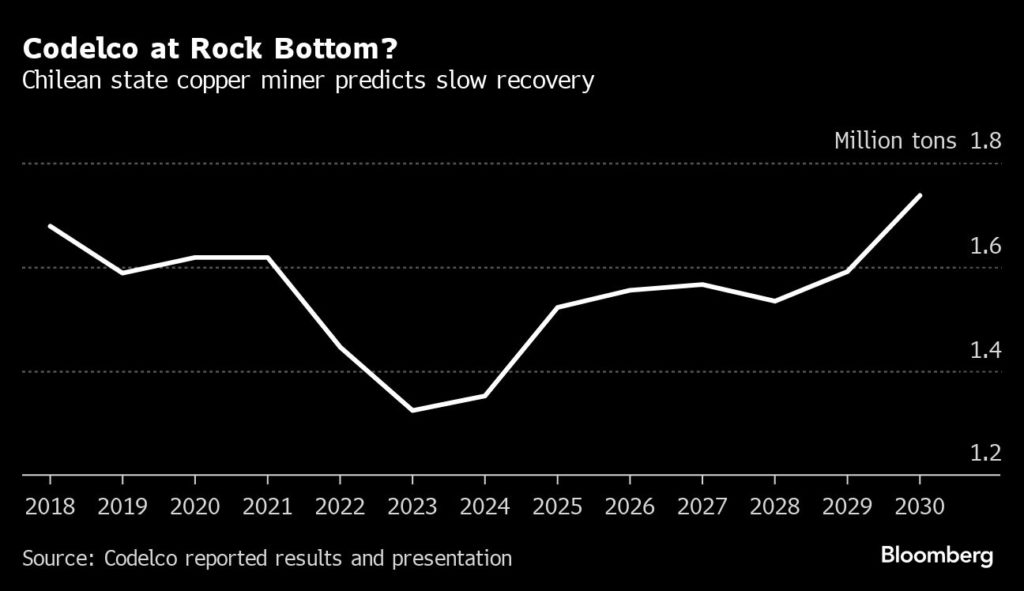

Proceeds will help the mining giant continue the overhaul of its aging deposits, seeking to compensate for a decline in ore quality that has seen production slump to a quarter-century low. Output has dropped much more than anticipated amid missteps and project delays.

“This is what happens when money is needed,” said William Snead, an analyst at Banco Bilbao Vizcaya Argentaria SA in New York. “Honestly, not necessarily a surprise given the funding needs.”

Codelco sold $1.5 billion of 12-year notes to yield 6.45%, as well as $500 million more of a previous issuance due in 2053, just four months after its prior sale. Both tightened from initial price talks of 265 basis points.

Still, the spread above the existing yield curve on the 12-year notes was higher than the spread on 2036 bonds sold by Colombia’s Ecopetrol SA earlier this month, an indication of the price Codelco had to pay to attract investors. Chile recently sold $1.7 billion of notes due in five years at a spread of 85 basis points over Treasuries, below its existing yield curve.

Codelco’s existing 2053 notes slid 1.3 cents to 95.3 cents on the dollar on the day of the issuance before recovering. The company’s bonds have the lowest returns since the start of the year among Chilean corporate dollar-denominated debt.

Still, demand for the new notes exceeded the offer by 3.75 times, with investors getting an attractive pickup over Chile’s sovereign bonds relative to other Latin American issuers, said Oren Barack, managing director of fixed income at New York-based Alliance Global Partners.

Codelco may have seen a window of opportunity given the risk of traders dialing back expectations of US rate cuts, Barack said.

“If rates move significantly toward the end of the year, which I think they will, they can go back to the markets,” he said.

Codelco needs the money after embarking on a $40 billion spending program following decades of underinvestment. Making matters harder still, it gives 10% of its sales and 70% of its profit to the state, making it dependent on debt markets to finance expansion.

The firm’s investment-grade credit rating has already been cut, and research center Cesco has warned that debt could rise to $30 billion by the end of the decade from over $20 billion now. New Chief Executive Officer Ruben Alvarado is looking for a gradual production recovery from this year.

“There’s no clear direction and the company is losing profitability and volume, and that makes it more vulnerable to price drops,” said Diego Ocampo, a senior director at S&P Global Ratings. “This path of continuing to issue debt to finance deficits deteriorates the credit profile.”

Still, further downgrades are unlikely given the government probably would support Codelco if needed, Ocampo said.

What’s more, “the recent downgrades and productivity issues seem for the most to be already priced in,” said BBVA’s Snead.