In June 2022, the National Bank of Ukraine imposed a UAH 60.4 million fine on Concord Bank, and a year later, in August 2023, it revoked the licence and liquidated JSC ‘Joint Stock Bank Concord’. The reason for this was the audit findings in the Bank, which revealed that it systematically violated the requirements of the legislation on prevention and counteraction to legalization (laundering) of proceeds from crime, terrorist financing and financing the proliferation of weapons of mass destruction.

As reported, Concord Bank served a quarter of the gambling market, which avoided taxation by using miscoding schemes – incorrect coding of transactions, which caused the Ukrainian budget to lose huge amounts of money yearly.

However, the founders of Concord Bank, sisters Olena and Yuliia Sosiedkas, decided to argue with the NBU and filed a lawsuit with the Dnipro District Administrative Court, which in May 2024 declared the NBU’s decision unlawful and cancelled the NBU’s decision. The regulator, in turn, filed an appeal. While the litigation around the issue of whether Concord Bank should remain in the Ukrainian market continues, we decided to investigate what this financial institution has been doing in the last years of its existence and whether there is a reason to liquidate another Ukrainian bank.

How Concord Bank earns money

Concord Bank is a very small-scale bank. Its main source of income is not lending, but Internet acquiring – accepting payments using payment cards on the Internet. In certain years, Sosiedkas’ Bank earned many times more from this than from loans. Thus, in the first half of 2021, this item brought Concorde Bank UAH 612 million in revenue: almost five times more than lending. Compared to January-June 2020, Concorde’s acquiring revenues have grown by one-third in recent years.

An integral part of this income is the so-called high-risk transactions: legal but risky transactions, for example, in favour of online casinos and bookmakers. ‘This includes all transactions where there is a risk that the buyer may demand money back,’ explained Olena Sosiedka, Chairman of the Supervisory Board of Concorde Bank, ‘These are not only betting and casinos but also, for example, airline tickets.

So, it is not surprising that in its decision to liquidate Concord Bank, which was ranked 36th among 72 Ukrainian banks with assets of UAH 5 billion as of 2021, the National Bank of Ukraine noted that its withdrawal from the market would not affect the stability of the country’s banking sector, as Concord’s share was just 0.17% of the assets of all solvent banks.

However, judging by the following, Olena and Yuliia Sosiedkas probably did not set out to develop a loan portfolio and expand their client base among individuals or legal entities, as it turned out that in banking, one can make money not only by doing this but also by providing services for fictitious financial transactions or converting illegal money into cash.

Why the National Bank revoked the licence and liquidated Concord Bank

In justifying its decision to liquidate Concord Bank during the court proceedings, the National Bank of Ukraine noted, among other things, that the audit findings in the Bank revealed that it had not systematically carried out appropriate measures to monitor the risk for business relationships and had not identified the risk criteria for using the Bank to legalise illegal funds, had not properly carried out or not at all reassessed the risk level for clients, and so on. In other words, Concord Bank turned a blind eye to many financial transactions that allowed illegal businesses to legalise illicit money through the Bank.

Which clients was it talking about? Among them are the following: FC Hunter LLC, Parishat LLC, Torpari 2020 LLC, Hanoi LLC, and Latrix Group LLC. There is almost no information about them in the public domain. According to the Unified State Register of Legal Entities, the founder and director of three of them – Parishat, Torpari 2020 and Hanoi – is Mykola Kramarchuk. He founded these three companies in the same period – in different months of 2020, and with the same core business activities – Data processing, hosting and related activities. As known, it was in August 2020 that the Ukrainian authorities legalised gambling, so it is likely that these Kramarchuk’s companies were founded to serve it, and they were audited by the National Bank as having laundered illegal casino and bookmaker money together with Concord Bank.

Another company listed by the NBU is Hunter, a Financial Company that provides money transfer services. Like Concord Bank, it is registered in Dnipro and was founded in 2020 by Yuliia Domina. It was she who managed the said Financial Company when it began to make huge profits: from UAH 192 million to UAH 642 million each year. In May 2023 the NBU revoked the licence previously issued to Hunter Financial Company, along with the licence previously issued to Concord Bank, for the same reason – money laundering.

How Concord Bank implemented a scheme to inflate its clients’ share capital artificially

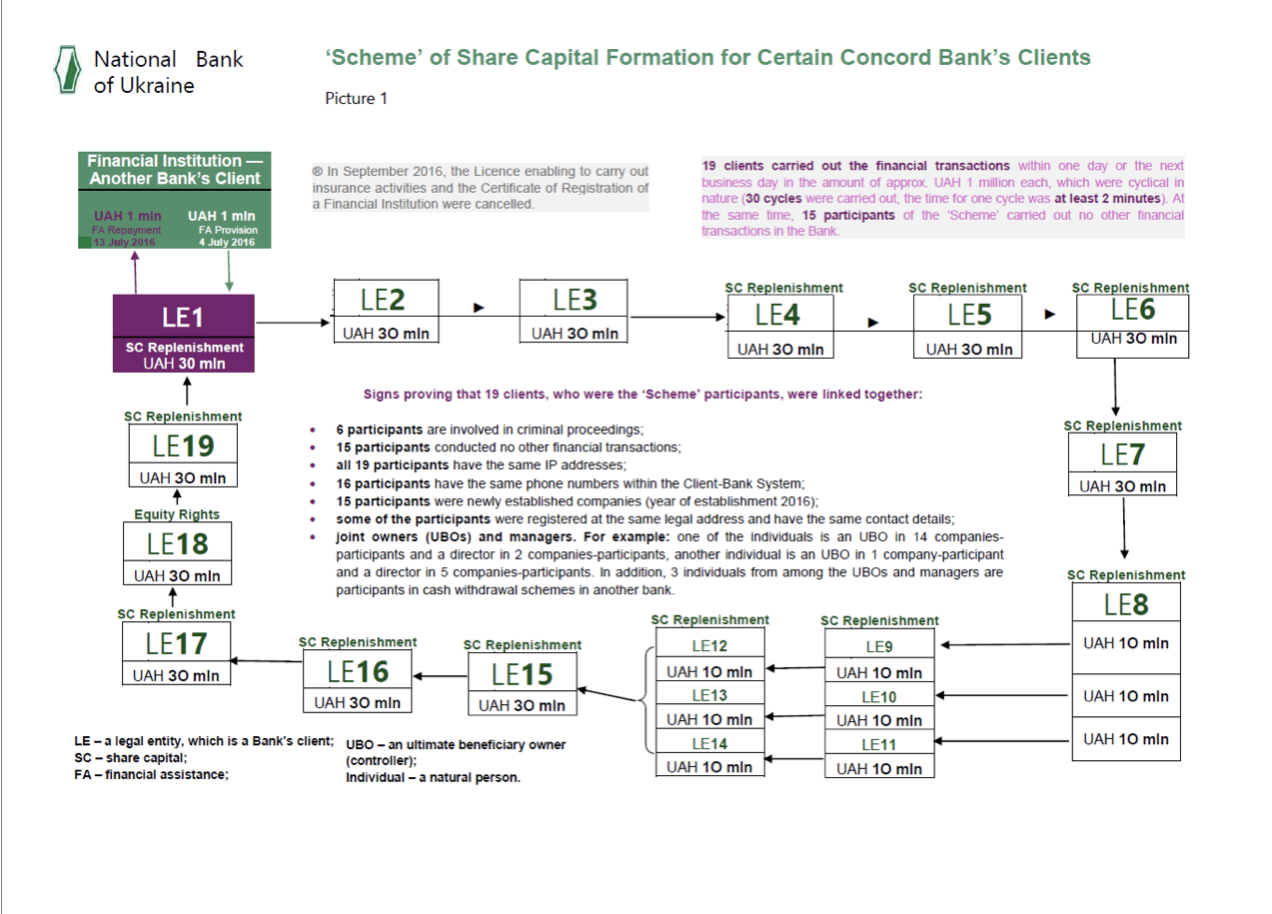

This is not the first time when the regulator has paid attention to the Bank owned by Olena and Yuliia Sosiedkas. In 2016, the NBU caught Concord Bank in fraudulent financial transactions. At that time, a group of 19 Concord Bank clients conducted financial transactions with each other at the expense of UAH one million. This was UAH 1 million received as a repayment of financial assistance by one of the group members. In one week – from 5 to 13 July 2016 – these companies ‘ran’ this UAH one million among themselves, conducting 30 transaction cycles of several minutes each.

Thus, as a result, 18 participants in the fraud ‘artificially’ formed a share capital amounting to UAH 420 million. Another participant received money for equity rights worth UAH 30 million. Some of the accomplices in the scheme who formed the ‘artificial’ share capital were later used to cash out the money and then transfer it to other banks from Concord Bank.

Concord Bank Clients Group-Owned Share Capital Fictitious Formation Scheme. Infographics of the National Bank of Ukraine

But at that time, the management of the National Bank of Ukraine was more lenient towards Concord Bank, and in 2018, the regulator imposed a fine of only UAH 1.2 million on Sosiedkas’ Bank for turning a blind eye to the above scheme, and thus immediate participation therein.

How Olena and Yuliia Sosiedkas helped businesses to evade taxes

In the Bank’s position published on Olena Sosiedka’s, Concorde Bank founder’s, Facebook page regarding the NBU’s decision to liquidate the Bank, it was stated that there were and are ‘no criminal proceedings against Concorde Bank or Olena and Yuliia Sosiedkas personally’. This, of course, is not true.

We have counted at least four criminal proceedings opened over the past ten years in which either Concord Bank or its founders, Olena and Yuliia Sosiedkas, were involved. All of them were initiated following the provisions stated in Article 212 of the Criminal Code of Ukraine ‘Tax evasion’.

In October 2016, officers of the State Fiscal Service in Dnipropetrovsk region discovered premises at 94 Sichovykh Striltsiv Street in Kyiv where a conversion centre was actually operating. The premises belonged to Olena and Yuliia Sosiedkas and their business partners Dmytro and Olena Fomenkos.

During searches of these premises, investigators found documents confirming that GUT LLC conducts illegal financial and economic operations, which, in the period from 1 January to 31 May 2016, by concealing the actual volume of products sold, evaded payment of value-added tax in the amount of UAH 1,905,326 and income tax in the amount of UAH 1,976,285.

In fact, this company was engaged in documentary coverage of non-commodity transactions and conversion of non-cash funds into cash at the premises owned by the Sosiedkas sisters.

The second criminal proceeding was initiated in October 2022 on the fact of deliberate tax evasion by PJSC Ukrtatnafta, as well as fraud. According to the investigation, on 17 February 2022, Ukrtatnafta officials entered into a fictitious foreign economic contract with the Swiss company NORDWIND TRADE SA for the supply of oil worth USD 20 million. Based on this fictitious contract, PJSC Ukrtatnafta transferred the USD 20 million from its bank account with Concord Bank to the account of NORDWIND TRADE SA opened with Raiffeisen Bank International AG in Austria.

In the framework of this criminal proceeding, according to BlackBox OSINT, Olena and Yuliia Sosiedkas were involved in a scheme that was subject to covert investigative search operations by investigators.

The third criminal proceeding No. 3201510000000024 dated 2 October 2015 against the Sosiedkas sisters was initiated based on a large-scale ‘laundry’ operation that was launched at Concord Bank in 2015. Then, according to the investigation, Olena and Yuliia Sosiedkas, together with their business partner Vadym Yermolaiev, who is currently under sanctions by the National Security and Defence Council of Ukraine for re-registering their business in the annexed Crimea under Russian law and paying taxes to the occupying country for many years (which was also done by Serhii Borzov, the former head of the Vinnytsia Regional State Administration, but he was not sanctioned for it), came up with a scheme enabling Ukrainian companies to evade due and payable taxes.

What did this scheme look like? The scheme participants transferred non-cash money from Ukrainian businesses that wanted to avoid paying taxes to company accounts opened at Concord Bank. In order to avoid attracting the attention of the tax authorities and law enforcement officers, the organisers of the scheme created false documents and reports to make it look like the transactions were legal.

The money was then given to representatives of the companies that ordered these ‘services’ from Concord Bank. To do this, investigators found that the Bank’s founders, i.e. the Sosiedkas sisters, obliged employees of PJSC ‘Joint Stock Commercial Bank ‘Concorde’ to rent individual bank safes at the Bank’s premises between 2014 and 2016. According to the developed criminal scheme, the owners of these safes – bank employees – issued letters of authorisation to use the safes to other persons – representatives of the conversion centre.

After receiving the money to the settlement accounts of companies with signs of ‘fictitiousness’ and cashing them out, an employee of PJSC ‘JSCB “Concord’ deposited these funds in individual bank safes registered in the names of employees of Concord Bank. Subsequently, representatives of the conversion centre, headed by Bank employee Andrei Korchahin, withdrew cash from the safes and transported it following a power of attorney. For all the above, the Bank received its percentage of the amount.

In addition, the scheme was used not only by Ukrainian but also by foreign companies, including Whitesboro Limited, Quinn Holdings Sweden AB, Vinci Capital Management Ltd and others. Abroad, Concord Bank conducted transactions through a correspondent account in the Estonian Versobank owned by Vadym Yermolaiev. This is confirmed by the fact that on 5 March 2015, Concord Bank posted a notification on its website that a multi-currency account was opened with Versobank.

‘The criminals, having the constituent and registration documents, opened current accounts for the respective entities in the Estonian bank Versobank AS. They received access keys to the Client-Bank electronic payment system and clichés with round seals, which allowed them to create and issue fake primary financial and business documents on behalf of these companies regarding fictitious transactions for the sale (purchase) of goods, performance of works, and provision of services to enterprises in the real sector of the economy. In this way, they received non-cash funds as payment for allegedly sold goods or services, and then cashed the money, avoiding taxes and limits set by the National Bank of Ukraine. In addition, clients were provided with illegal services for the purchase of foreign currency on the interbank foreign exchange market of Ukraine under fictitious contracts using non-resident affiliates,’ as set out in the criminal proceedings.

Another proceeding No. 3201504164000004 dated 8 September 2015 also involved ProCard LLC based on suspicion of tax evasion. ProCard is a processing company that supports card projects of its partners within the Visa and MasterCard International Payment Systems. From 2011 to 2024, the sole founder of ProCard LLC was Yuliia Sosiedka, and today the company is re-registered to Konstiantyn Petrenko.

According to the investigation, the firm was involved in fictitious business transactions between several companies, which led to the illegal formation of a VAT tax credit worth above UAH 4 million.

Apparently, somehow the Sosiedkas sisters managed to avoid punishment for the above-mentioned crimes. However, the opposite would be surprising in our country. Therefore, the impunity of Concord Bank for facilitating tax evasion by businesses and organising a conversion centre based on the Bank naturally led to an increase in the appetite of the Sosiedkas sisters.

How Concord Bank serviced drug trafficking and illegal gambling in Russia

Namely, to servicing drug trafficking and illegal gambling. The founders of Concord Bank, whose main activity is high-risk transactions, at some point realised that it was possible to conduct not only legal high-risk transactions but also illegal ones.

On 21 September 2021, the United States imposed sanctions against Suex, the Russian and Czech Cryptocurrency Exchange Service, for helping to facilitate transactions involving illegal proceeds. According to the US Treasury Department, more than 40% of transactions involving Suex are related to illegal activities. These include payments for the purchase of drugs on Hydra, the Russian Drug Marketplace, which has an annual turnover of at least USD 1.5 billion.

What does Concord Bank have to do with it? ‘Stopnarkotik’, the Russian Social Movement and the Badbank Telegram channel accused Ukraine’s Concord Bank of accepting payments in UAH through the HotPay Payment Aggregator in favour of ExMo, the well-known Eastern European Crypto Exchange, which in turn redirected payments to the SUEX Crypto Exchange, which cooperates with drug traffickers.

In addition, it was reported that the Ukrainian Concord Bank, through its ProCard Processing Centre and in cooperation with the Russian PJSC Promsviazbank, which is the main bank of the defence sector of the Russian Federation (the composition of the bank’s board is classified), provided services to illegal bookmakers in Russia and former Soviet countries, as well as to FXCoin Cryptocurrency Exchange Service, which is also involved in servicing drug traffickers.

Cooperation with Russian illegal structures and legitimate banks, such as Promsviazbank, is not the only thing that connects the Sosiedkas sisters with the aggressor country. It should be noted that, to all appearances, Olena and Yuliia Sosiedkas do not disdain ties with Russians in principle and are not particularly principled in this matter.

In 2018, Olena Sosiedka registered her ownership of real property in the annexed Crimea. For this purpose, she issued a power of attorney to Irina Shportko, a Russian citizen. In addition, a close friend of Olena and Yuliia Sosiedkas is a Russian citizen, Daria Omelchenko, who has a Russian phone number and a registration address in Moscow at the address: 52 Admiral Lazarev Street. Omelchenko was a marketing representative of Concord Bank and, according to her social media posts, is in close relations with the Sosiedkas.

Olena Sosiedka’s husband, Viacheslav Mishalov, has a joint business with Yevhen Kryvenko, a confidant of Hennadii Hufman, the first deputy head of the Dnipro Regional Council from 2020 to 2022 and a member of the regional council from OPFL /in Ukrainian shortly – OPZZH/, the pro-Russian party, who fled Ukraine in July 2022. Mr Hufman is known for being involved in several investigations into the illegal withdrawal of communal property from community ownership, as well as for his links to Russian agents Oleh Tsarev and Viktor Medvedchuk.

How Viacheslav Mishalov, the Olena Sosiedka’s husband, made his fortune

Speaking of Olena Sosiedka’s husband. He is also an interesting character, and just like his wife, he has been involved in criminal proceedings. Viacheslav Mishalov is a Deputy of the Dnipro Municipal Council elected from the ‘Samopomich’ Party, and from March 2016 to 2017 he even served as the Secretary of the Dnipro Municipal Council. He is a co-owner of the Internet portal I.UA, has a small share of 0.8% in the NPO Dnipropress LLC, Metallurgical Plant, where he was previously the chairman of the Supervisory Board and CEO, and is a co-founder of the Fregat Internet Provider.

Viacheslav Mishalov. Photo: Instagram

In his 2020 declaration, Mishalov listed ownership of 18,000 bitcoins at once, which at the time was worth more than $1 billion, a collection of 13 expensive watches from well-known brands such as Rolex, Jaeger-Leculter, Audemars Piguet, Breitling, Glashutte, etc. and a collection of rifles. Where did he get such wealth? Perhaps he employed the practice to misappropriate the funds from the budget, which law enforcement officers accused Mishalov of.

In January 2020, the police and the prosecutor’s office launched an investigation into the possible misappropriation of funds by Master-Bud during the installation of heat generators and boilers in kindergartens and schools in Dnipro worth UAH 33.7 million. In 2016, the utility company Komunzhytloservis ordered Master-Bud to install 14 boilers of various capacities. The amount of UAH 33.7 million was paid in full. However, the investigation found that Master-Bud overstated the cost of the equipment by UAH 7.1 million and included unreasonable costs for soil transportation in the certificates of completion, which could have further inflated the cost by another UAH 588 thousand.

At that time, Viacheslav Mishalov, who served as the secretary of the Dnipro Municipal Council, had a direct connection with Master-Bud, as until 2018, the company was co-owned by his father, Dmytro Mishalov, one of the most influential businessmen in Dnipro, whose Master-Bud company won the trust of Deputy Prime Minister Borys Kolesnikov in 2010 and was awarded a $100 million contract to build a roof over Kyiv’s Olimpiyskiy Stadium. In addition, the boilers for Master-Bud were supplied by Liberator, a company whose trademark is owned by Viacheslav Mishalov himself. Not surprisingly, financial transactions were carried out through Concord Bank.

In 2019, Dnipro Mayor Borys Filatov publicly accused the Mishalov family of corruption in connection with the delayed repair of the Dnipro bridge, which was carried out by Dmytro Mishalov’s ‘Zavod Master-Profi’ Company. The company received UAH 250 million from the city budget for this. Filatov then openly expressed his desire to see the Mishalov family held criminally liable for their actions.

By the way, Dmytro Mishalov and his son Viacheslav were members of the board of trustees of the Dnipro Jewish community, which also included Ihor Kolomoiskyi, Hennadii Boholiubov, Hennadii Korban and other influential figures. After Viacheslav Mishalov was elected to the Dnipro City Council as a member of the ‘Samopomich’ Party in October 2015, Master-Bud received public contracts worth a total UAH 2.03 billion.

How Olena Sosiedka withdrew millions of state-owned Ukrgasbank to Austria

According to BlackBox OSINT, over the three years of Russia’s full-scale war against Ukraine, Olena Sosiedka has travelled abroad 26 times. She most often travels to Switzerland, but also visits France, Italy, Israel, where her sister Yuliia Susidka lives, and Austria.

Olena Sosiedka’s ties to Austria are not only due to her children’s residence there. The father of her second son, Serhii Dovhaliuk, a former head of the Concord Industrial and Financial Group associate, was managing director of the now liquidated Austrian companies Concord Engineering GmbH, APS Power Technology GmbH and Concord Solutions Lab GmbH, which are linked to Concord Bank and the Sosiedkas sisters, in 2010-2014 and 2020-2024.

How Serhii Dovhaliuk, the father of Olena Sosiedka’s second son, is connected to Concord Engineering GmbH, an Austrian-based company

APS Power Technology GmbH is the founder of the Ukrainian company Bio Energy Dnipro LLC. In 2018, Olena Sosiedka acted as a mortgagor on a loan to Bio Energy Dnipro obtained from PJSC JSB Ukrgasbank for the implementation of a natural gas substitution project – the construction of a liquefied natural gas power plant. But it was most likely a fictitious project, as it was never implemented. However, the loan was received and, according to BlackBox OSINT, was not repaid.

According to information from the Unified State Register of Court Decisions, as of 2022, the debt of Bio Energy Dnipro LLC to PJSC JSB Ukrgasbank amounted to almost EUR 3.4 million, and the court issued a compulsory order to recover the debt, which was planned to be paid through the sale of the company’s property worth UAH 18 million, which in 2022 was only about EUR 493 thousand – almost 7 times less than the amount of the loan. Part of it – USD 100,000, according to open data from the export-import operations database – was transferred in November 2019 by Bio Energy Dnipro LLC to Concord Solutions Lab GmbH, also controlled by Olena Sosiedka. It is likely that the rest of the loan funds met the same fate.

As a result, the court banned the company owned by Olena Sosiedka and the father of her second son, Serhii Dovhaliuk, from building a biogas power plant. This means that EUR 3 million from Ukrgasbank was not used for its intended purpose and was not returned to the bank. Given that in 2016-2018, the director of APS Power Technology GmbH and Concord Solutions Lab GmbH, both controlled by the Concord Group, was Alexandre Egger, a lawyer for former Prime Minister Mykola Azarov at the European Court of Human Rights, it is highly likely that Olena Sosiedka used him as a specialist in withdrawing the state bank’s funds from Ukraine to Austria.